Why discounting your game works: psychology edition!

Also: the big guns - and blockers - come out in MS x ATVI.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome to mid-week madness, GameDiscoverCo style! In this very newsletter, we’ll dazzle, we’ll delight, and.. well, mainly we’ll just type a bunch of stuff about video game discovery, and make you read it. But you knew that already?

BTW, shout-out to all the teams doing great in Steam NextFest right now! Stealth ‘megahit in the making’ Dark & Darker is poles ahead in peak demo CCU right now. But we’ll have a full rundown for you in Monday’s newsletter. Avanti…

How discounting your game grabs players’ brains..

We’ve been following the work of Jamie Madigan, a psychology Ph.D. who runs a site called The Psychology Of Games and has written a book on the subject, for some time now. So we were delighted to see him discussing, in podcast form, a subject we’d been meaning to tackle for some time.

That is, simply: “The psychology behind [discount] sales, especially digital sales that have no physical items or [real] storefronts involved. What are some of the things that digital storefronts do - either intentionally or not - that you should know about, so that you can approach sales on your own terms?”

So - platforms, discounts, discovery - it’s right up GameDiscoverCo’s alley! We reached out to Jamie for more context - and here are some takeaways for you all:

Consumers have irrational attitudes toward sales: perhaps this is semi-obvious, but looking for deals is - in itself - an activity that players love: “Many find value in bargain hunting, beyond simply what they're saving… it's fun to come back and see what the daily deal is. And it's fun to think if we should buy this while we have the chance, before it goes away.” You see this in the Epic Games Store weekly ‘free game’ deal, which is a platform retention tool in itself, whether people play the game or not.

Artificial scarcity is often used to make people want something: this is because of “the ‘rare means valuable’ shortcut that we often use for decision-making.” You’ll sometimes see ‘only X copies available at this price’ in the physical space - that’s the reason for the original naming of Limited Run Games. But in the digital space, it’s all about equating ‘time to buy is limited’ to scarcity.

‘Anchoring’ makes players biased toward the first number that you see in a sales pitch: Jamie comments: “This is often used to raise your estimate of how much something is worth or how big a discount is.” Obviously, in digital storefronts, you’re not haggling in an interactive way, like with a used car dealer. But the fixed discount is still anchored on that expensive default price - ‘was $29.99, now $7.49’.

But that’s not all! We’re giving you six bullet-points for the price of three in this very special GameDiscoverCo newsletter, folks. (Wait, am I anchoring here?)

‘Surprise’ sales events and digging for bargains is ‘a real-life loot drop’: again, it’s the unexpected that delights our brains, and as Jamie notes: “All the same lessons about randomness of rewards apply that they do to other areas of learning and rewarding and reinforcing behavior.” There’s been plenty of research confirming that this is the case.

Wishlists and pre-orders use pre-commitment to buy in order to get more sales: this is an interesting one! As Jamie notes: “People don't like inconsistencies between their stated intentions and their actual actions.” He actually referenced that he will add games to his Steam wishlist, and then later on, Steam will remind him that it’s available for the first time, or it’s 50% off. At that point, you may feel like you should follow through on the wishlisting ‘promise’ and buy!

‘Psychological reactance’ makes us overvalue something when we think we’re about to lose the opportunity to buy it: digging further into this, the most obvious examples of these are the Steam front page ‘Midweek Madness’ and ‘Daily Deal’ sales, which list an exact time and date they end at. But even the Switch eShop now does the ‘countdown to no more discount’ prominently.

Anyhow, these ‘discount your premium game’ principles exist - and are probably a key reason that many of us have a big backlog of Steam games. Perhaps they will become marginally less important, as we move into a big game and subscription-led world.

But I suspect even for larger GaaS titles, there are lessons to be had here - particularly for those which sell limited-time Battle Passes (aha!), bundles of in-game currency (check!), or do anything with additional commerce in-game. Which is…. all of them?

Activision & Microsoft release the Kraken Kotick?

Look, you could tell things were getting serious with the Microsoft x Activision deal approval when Activision Blizzard’s CEO Bobby Kotick turned up on CNBC yesterday to talk about why the $68.7 billion all-cash deal should be approved by regulators.

Kotick is a super-sharp businessman, but his reputation for the cut-throat precedes him (see Wikipedia article section: “He has focused on developing intellectual property which can be, in his words, ‘exploited’ over a long period, to the exclusion of new titles which cannot guarantee sequels.”)

And the timing of the deal - with the ‘feel-good Microsoft in 2022’ vibe swooping in to take over an Activision Blizzard that was besieged by negative press over sexual harassment and Kotick’s behavior - seemed designed to have him fade decidedly into the background.

But with the whole deal on a knife-edge - and Activision putting out some pretty good results thanks to its mobile titles, Call of Duty: Modern Warfare 2 and Overwatch 2, Kotick was, uhh, ‘released’ to chat about industry trends and the pending deal.

So yes, his CNBC appearance certainly surfaced a menacing turn of phrase towards the UK & Chancellor Jeremy Hunt’s famous ‘I will fire up our country to be the next Silicon Valley’ quote, with Kotick riposting: “If a deal like this can’t get through [regulators], they are not going to be Silicon Valley - they will be Death Valley.” Heyooo.

But Kotick’s more detailed comments on what he thought regulators had wrong, per VGC, were intriguing on trends: “I don’t think they fully appreciate that [the game industry is] a free-to-play business, that the Japanese and Chinese companies dominate the industry… the best companies in the world right now are companies like Tencent and ByteDance, and these are companies that all have protected markets.”

So his view seems to be - why is the UK, Europe and the U.S. considering blocking this big deal, when the largest players aren’t even HQ-ed on those continents & have government backing? He added: “We’ve struggled to enter the Japanese market, we can’t enter the Chinese market without a joint venture partner, so the competition isn’t actually European companies, American companies, it’s really those companies in Japan and China.”

So - yep, this is certainly a spin. And we don’t think this is intended to be a throwback to Black Rain-style U.S. xenophobia associated with the rise of Japan in the ‘80s. (Kotick apparently identifies as a libertarian, so ‘governments, don’t mess with valid business deals’ seems to be his main credo here.)

Still, there’s definitely a case to be made that the console side of the deal is being over-concentrated on. Kotick said the rise of mobile devices & game-playing beyond ‘the middle classes’ in developed countries has been the big story of the last decade in games. And Maciej Jałowiec’s analysis of the ATVI results pointed out:

“Mobile represents 47% of total revenue. With Call Of Duty Mobile growing its quarterly results in double digits YoY, Diablo Immortal contributing to results for only half of 2022, and… Blizzard [not finding] a way to serve Chinese consumers after terminating the deal with NetEase, it wouldn’t be surprising to see ATVI becoming a mobile-first company in 2023.”

But either way, the UK’s Competition & Markets Authority (note the word ‘authority’ in there - what they say goes!) made its provisional ruling on the Activision deal today. And it ain’t good news for Microsoft or ATVI. Specifically:

“A CMA investigation has provisionally concluded that Microsoft’s proposed acquisition of Activision could result in higher prices, fewer choices, or less innovation for UK gamers… At this stage, the CMA has identified the following possible structural remedies: ‘(a) Requiring a partial divestiture of Activision Blizzard, Inc. This may be: (i) Divestiture of the business associated with Call of Duty; (ii) Divestiture of the Activision segment of Activision Blizzard, Inc… which would include the business associated with Call of Duty; (iii) Divestiture of the Activision segment and the Blizzard segment of Activision Blizzard, Inc… (b) Prohibition of the merger.’”

So there we have it. Your move, Microsoft?

The game discovery news round-up..

Finishing things up here, before Friday’s Plus-exclusive newsletter pokes at how big Hogwarts Legacy can possibly be, let’s take a look around the big discovery news:

Nintendo’s fiscal results happened, with the Switch making it to a 122 million install base, outselling PS4. There’s a slight slowing, but still good results: “Quarterly revenue was $4.68B, or 8% lower YoY. Still, its 2nd best quarter since FY 2010. Operating profit declined 25% to $1.39B. 3rd best since FY 2010.” It shifted down its full-year Switch estimate by 1 million, but also said it’s not planning price cuts.

You maybe heard that the enhanced paid version of Dwarf Fortress sold 606,000 units in its first 2 months on PC (wow!) But bonus facts: just under 1% of those sales (5,000) were via Itch.io, and publisher Kitfox’s CEO Tanya Short commented on the gross to net: “Some people are wondering how 500k* Dwarf Fortress units for $30 turns into "only" $7 million. 1. SUBTRACT: - ~50k units returned/chargebacks - taxes - Steam's 30% 2. remove Kitfox's recouped investment, then 20% [publisher cut] you'll get ~$7m!”

What exactly happened with Blizzard and NetEase’s China licensing deal? The China Project has a super-detailed rundown of what went down, echoing the current situation: “The Blizzard-NetEase fallout has not only shocked Chinese gamers, but it has also baffled industry insiders and analysts alike.”

Xbox Wire put out a ‘why PC Game Pass is empowering developers’ piece, which includes: “Game Pass members play more genres, they play more games, and 90% of them play games they wouldn’t have played otherwise.” (There’s also “Game Pass members spend 50% more on the Xbox store than non-members, on games both inside and out the catalogue” - but receipts needed re: segments & correlation/causation.)

Did you know that EA has an EA Play Pro subscription that’s only available on PC via Origin and the EA app, and allows instant Dead Space (remake) access for $15/month or $100/year? (I didn’t, since the ‘vanilla’ EA Play is far more common due to its Xbox Game Pass Ultimate inclusion.)

Shout-out to Ravenage’s Artem Korovkin for doing a DevGAMM microtalk about Steam benchmarks, also available in blog form, which compiles some of GameDiscoverCo’s research - and others - on ‘reviews to sales’ multiplier, followers to wishlists and more in one place.

It’s a weird niche, but look, Japanese retail game sales Top 100 for all of 2022, headed - of course - by Pokemon Scarlet/Violet, which shipped 4.3 million copies physically (and over 20 million worldwide!) 89% of the Top 100 by unit were Switch games, with 7% PS4 and 4% PS5 - but that’s the Japan market for you.

More evidence that the middle of the market is rough nowadays in PC/console? EA chatted to GamesIndustry.biz re: EA Originals, “We've discovered a desire for bigger, better and more innovative titles that complement the EA portfolio… we started off with smaller, indie games… we are moving away from niche, and towards bold and audacious.” Think more Wild Hearts-sized titles?

Coupla mobile stats: Data.ai has a ‘state of mobile’ report that reveals “time spent on mobile grew 9% worldwide in 2022”, with UK users phone-gazing for 4.2 hours per day; top mobile downloads for January include Candy Crush Saga & Free Fire, with top grossing headed by Honor Of Kings, PUBG Mobile & Genshin Impact

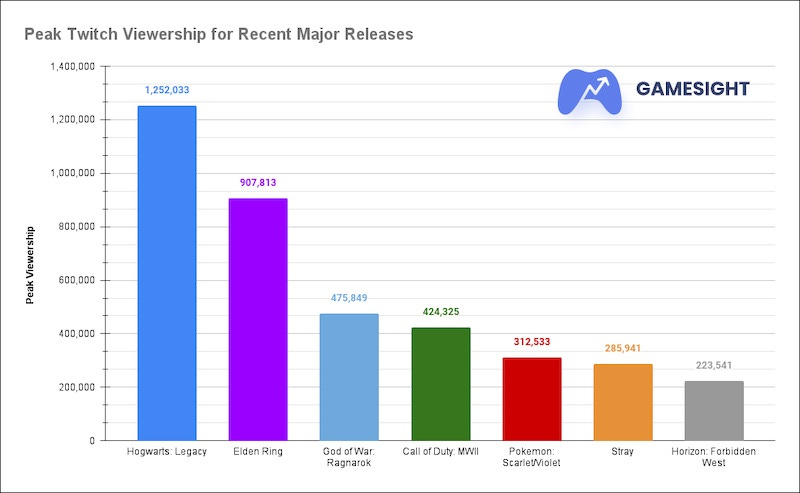

Fine, a tiny preview of Friday’s newsletter content re: Hogwarts Legacy - Gamesight has spotted that its 1.25 million CCU launch for Twitch viewers outpaced all the recent ‘big hitters’ (above). And according to SteamDB, its ‘Early Access’ on Steam already has 500,000 CCU - that’s actual players. Wow.

Finally, UK outlet the NME has been doing neat game dev profiles of recent, such as with Electric Saint’s Anna Hollinrake. And they’ve actually been commissioning developer photoshoots alongside them (!)

Making game devs look stylish and human via the medium of photography is a) rare and b) a vibe we can get along with. Let’s celebrate it:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]