Who's winning game discovery on Discord?

Also: some intriguing PlayWay stats, and lots of game platform shenanigans...

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome to a fresh week in game discovery, folks. (And it’s just 7 days until the spookiest day of the year, Halloween. Are you excited, and do you have your Halloween in-game tie-ins sorted out already for the Steam Scream Fest? Woooo!)

Also, thanks to everyone who filled out to our Steam ‘reviews to sales’ 4-question survey so far - we got over 125 responses and counting. We’ll close the form on Friday, Oct. 28th, so try to fill it in if you have a live Steam game. We’ll print the results soon.

PSA: Company subscriptions to GDCo Plus got easier!

Before we kick off, here’s a cool update to our GameDiscoverCo Plus subscriptions! We used to limit the amount of ‘companion’ subs with a ‘Company Subscription’ ($500 per year), and ask that you contact us with new email additions. (It was a bit fiddly.)

But now, if you sign up for the $500/year deal on behalf of your company, we’ll upgrade all existing subscribers with the same email domain as you to Plus, automagically, whether it’s 10 or 50 people. All get the extra newsletters, data access, Discord, etc. (We just upgraded 100+ emails over the weekend due to this!)

And we’ll check every month and add new free subscribers from your company to the Plus tier, all without you needing to do anything. We’ll also still add specific new email addresses (or answer Qs) if you ping us. But this streamlines everything neatly…

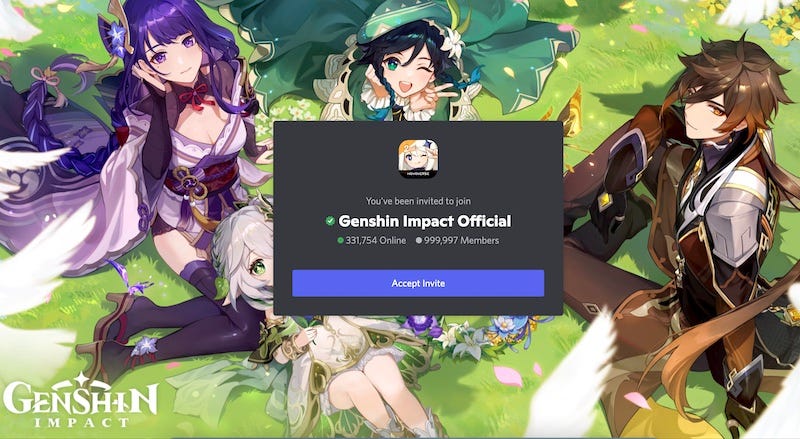

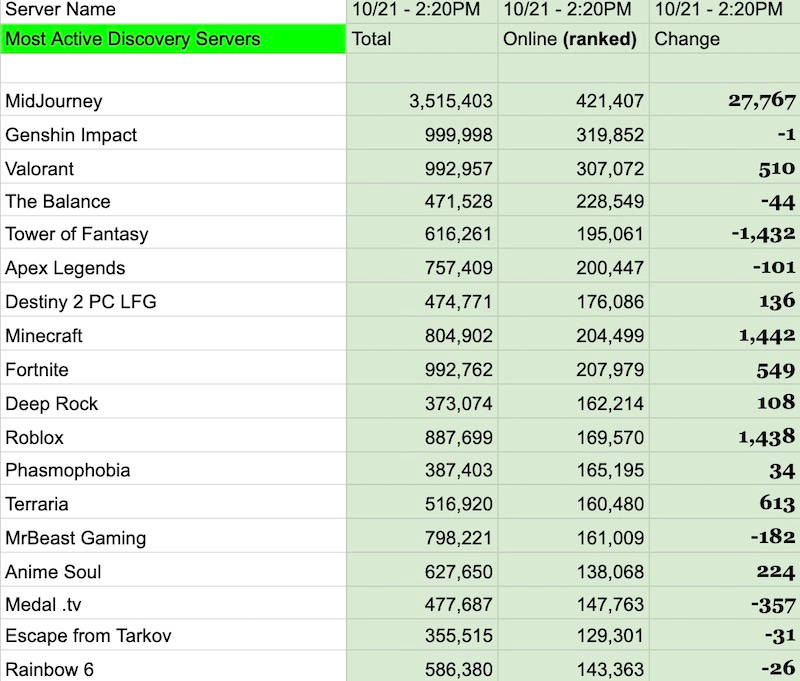

Who’s ‘winning’ Discord in 2022? Some fresh data

We last checked in on the state of Discord for game devs with 505 Games’ Stephen Takowsky back in 2020, who keeps a close eye on the biggest Discord servers for games & beyond, via this comprehensive, weekly-updated chart.

So we were delighted when he got back in touch. Specifically, here’s all the top public Discords, sorted by # of people online last Friday & including day-on-day change (but with overall ranking position from last Monday):

This is pretty fascinating on its own - especially seeing big GaaS titles like Tower Of Fantasy doing so well, as well as the Discord for online game clip tool Medal.tv. But Stephen has a bunch of extra commentary, as follows:

Outside of video games: “Recently, the MidJourney server has completely dominated in terms of growth/activity… their server revolves around their AI bot that creates artwork using keywords. Discord has made an exception, and permitted this server to grow past the [normal] 1 million user server cap.”

But he does note: “If you look at active online users, [Midjourney’s] are still very close to Genshin Impact. This is because over the last year, Genshin Impact has repeatedly pruned their inactive members who have not logged into their Discord over the last 7-30 days. This has made their server extremely efficient when it comes to ‘online to total members’ ratio.”

Here’s an interesting point about trends: “There are some servers who might appear like they are… massive. But in reality a large portion of their server haven't used Discord for more than 30 days. For example, Splitgate was a popular server early on in the year, but over the last several months, each day they only have a net daily loss of members.”

You can see this in Stephen’s trends doc. Right now the Splitgate server has 452,000 members and ‘only’ 70,000 active - which is a pretty big drift down from 793,000 members and 182,000 active in September 2021. (There are recent reasons for that. But interest seemed to be waning, even before the Splitgate devs decided to pivot to a new game.)

So yep, maybe limiting total Discord member count is a little odd. But it’s how Discord is choosing to manage its growth right now for the very highest-end servers, presumably due to cost/complexity.

As Stephen notes: “Discord often wants servers to prune their members who are at least 30 days inactive. This is very different than social media platforms such as Twitter, Facebook, TikTok and Instagram, who would never ask groups, pages, and profiles to remove their inactive members.”

Finally, Stephen points out that many top Discord servers have lost members or dropped out of the Top 15 charts: examples include: Call of Duty, Splitgate, Elden Ring, Animal Crossing, Lost Ark, Rust, r/LeagueOfLegends, Rocket League, and Escape from Tarkov. (But many are still doing fairly well - just not quite Top 15.)

And evergreens staying in the Top 15 include Minecraft, Stephen’s own Terraria Discord, Apex Legends, Fortnite, Valorant, Genshin Impact, Phasmophobia, Deep Rock, Roblox, Destiny 2 PC LFG, and MrBeastGaming. And the new servers in the Top 15 are the aforementioned MidJourney, Medal.tv, and Tower of Fantasy.”

One other tidbit from Stephen. Although most players don’t use Discord’s ‘server discovery’ to find new Discords, discovery via this method has changed: “The Discord ‘discover’ button features many servers organized into various categories. However, the Home button no longer organizes servers by most active - and instead organizes servers based on Discord’s own algorithm that greatly incorporates recent net new members.”

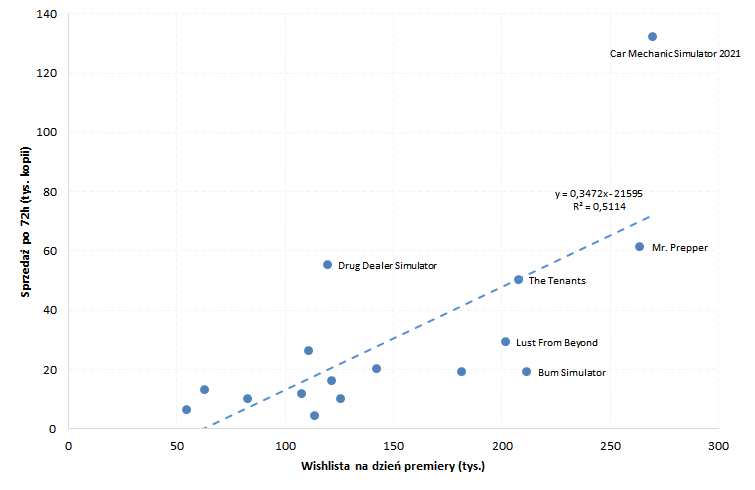

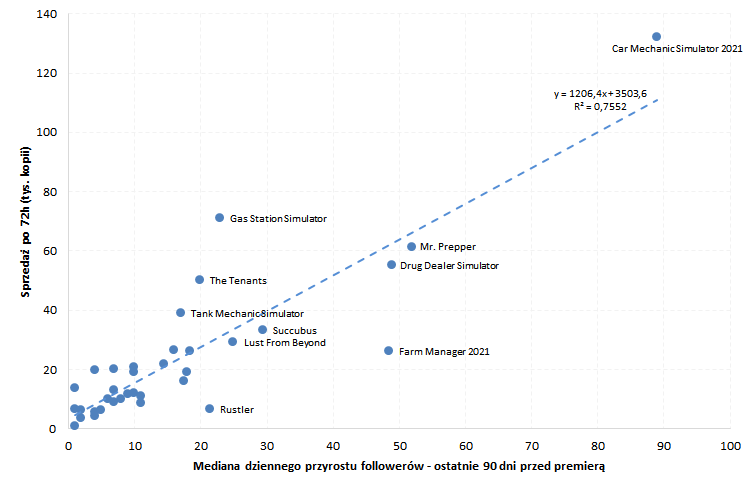

You want PlayWay data? Here’s PlayWay data!

We’ve been sitting on this for a while (sorry!), but the folks at Polish stock market site PortalAnaliz.pl put out a very detailed article on the Steam data for PlayWay and its affiliates. (It’s Polish-language, but Google Translate does a decent job with it.)

As you may know, PlayWay - whom we’ve discussed in-depth in the past - is one of a large amount of affiliated game publishers/devs who are publicly traded in Poland. This has led to two things: more stock market analysis, and very transparent Steam data disclosure from the publishers.

That’s how you get neat things like the above graph, which is ‘# of Steam wishlists in thousands on release’ on the X axis, compared to ‘# of units sold in the first 72 hours’ on the Y axis. (The article does claim a 0.72 correlation there, which is above average)

But as you know with wishlists to sales, it’s more of a ‘indicative’ comparison than a precise one. As the article puts it: “Games with few wishlists [at launch] rarely achieve significant success. While a high wishlist does not always translate into equally good sales, a low wishlist almost guarantees a poor - or at most average - sales reception for the game.”

Elsewhere, there’s a lot of interesting work done on Steam follower count for PlayWay games, and how this predicts success. The writer believes that pure ‘follower count at launch’ is not that indicative of initial sales, at least with PlayWay-affiliated titles. (I think some of PlayWay’s marketing methodology may affect things here, though?)

Nonetheless, with this data set, he found that ‘median daily Steam followers added in the 90 days up to release’ had the best (0.87) correlation to sales for PlayWay - even better than wishlists! Which is neat, since we can all see Steam follower counts for all games.

There’s plenty of other fun stuff in here. This includes:

a look at how PlayWay’s CCU peaks for standalone Prologues prefigure units sales for its games (it’s got decent correlation at 0.58, but not spectacular!)

how ‘maximum CCU’ on launch day predicts ‘72-hour unit sales’ (unsurprisingly, a 0.95 correlation!),

how the number of reviews predicts those sales (0.89 - gratifyingly high, at this early stage!)

Anyhow, I’ve rarely viewed this degree of proper statistical analysis on specific Steam games. So it’s great to see it - even if PlayWay’s data set is sometimes a little odd, due to the amount of time they leave games dormant and ‘hanging out’ on Steam before launching. But it’s all still super valuable!

The game discovery news round-up..

And we’re finishing out, at least until Wednesday, with the following notable stories from the game discovery and platform-verse:

Steam hit a super-big milestone over the weekend, as my colleague Alejandro noted - over 30,000,000 simultaneous users simultaneously online on the platform! TomsHardware notes that: “During weekends in 2022, concurrent users of Steam have typically peaked in the region of 27 to 29 million. The last highest concurrent user quota was at the end of March 2022, when 29,986,681 users were busy on the platform.”

What the heck happened in the Epic vs. Apple U.S. antitrust court appeal last Friday? Ah, well, you didn’t hear about it because it didn’t happen. “Due to the unforeseen unavailability of a panel member”, it was postponed. But: “Fortunately, the delay is limited: the appeals court just gave notice of a new hearing date: Monday, November 14, 2022, at 2 PM Pacific Time.” Set your Mickey Mouse alarm clocks!

The price of Apple Arcade itself isn’t going up, but bundled Apple One subscriptions are increasing in price, alongside Apple Music (+$1) and Apple TV+ (+$2) standalone sub increases. So you’re paying more for your sub that includes Apple Arcade. But overall, AA is still a bit… deprioritized, right?

Looks like Sony has removed expiration dates from PlayStation Plus games: “Sony's made clear when games would leave PlayStation Plus since the service relaunched back in June. But now those expiration dates are gone without any explanation.” FWIW, Xbox doesn’t say games are leaving Game Pass til the last minute, since they might be working on renewal deals. So this... makes sense?

September 2022’s NPD U.S. hardware/select game results showed $4.1 billion in revenue, down 4% YoY, with “double-digit percentage growth for both PlayStation 5 and Xbox Series consoles” helping out - Mat Piscatella says “improved supply of PlayStation 5 was a primary driver of the [hardware $] increase.” Lots more in the thread.

HowToMarketAGame’s Chris Zukowski is doing a survey on Steam Next Fest performance, if you would like to contribute your game’s results to his pile! His previous round-ups of Steam Next Fest performance have been super helpful…

If you didn’t spot, Twitch’s gambling rules got further revised, with a “further tightening our rules to also prohibit any streaming of listed sites that contain slots, roulette, and dice games and are unlicensed in the U.S. or other jurisdictions that offer consumer protections.” But sports betting, fantasy sports, and poker are still fine. (We’ll have more on the proliferation of gambling-like monetization soon…)

The Bytedance-backed standalone Pico 4 VR headset has had some pre-order shipments delayed to Europe. Overall, it launched with a decent catalog, and UploadVR was positive about Pico 4’s tech/form factor vs. Quest 2, but “the content ecosystem is far less developed, the software isn’t as refined, and the processor can struggle to keep up with higher resolution.”

CD Projekt’s GOG PC game platform - historically known for ‘good old games’ - is announcing a partial content shift: “Many great titles designed to be played with friends are not available here, and we want to change that. For us, it is crucial that we explain our thoughts on introducing more online games.” It’s a tricky pitch alongside the ‘DRM-free’ marketing angle. But makes sense re: where the market is going…

Microlinks: the Quest store now supports timed game trials without devs creating a standalone demo; the games industry saw 976 deals in 2022 so far, totaling at least $123 billion; in ‘more transparency’ news, a Steam Deck patch allows you to view the precise components inside your Deck.

Finally, yes - we know that Rishi Sunak is now UK Prime Minister. But this Trombone Champ mod playing out his predecessor Liz Truss is really not to be missed:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]