Which genres have 'ruled' Steam? A new view!

Also: lots of news and this week's remaining game platform news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Hey, game discovery fans! We’re sidling into the weekend with a whole new set of data and takeaways on how people find your PC and console games. (With a bit of a summer ‘lilt’ in our step - as opposed to a ‘Fanta Pineapple & Grapefruit’, ugh.)

Before we start, we were delighted to hear that not only has roguelike standout Balatro been (unofficially) ported to the Game Boy Advance - but even more surprisingly, as: “a prototype meant to run… through a [Nintendo] e-Reader, a 2000s era accessory that loaded games onto the console via a strip of dot code printed onto a card.”

Game discovery news: it’s a Death… Bananza?

Let’s take a final look at the week’s game platform & discovery news? No sales numbers, no corporate acquisitions, just things relevant to our particular niche:

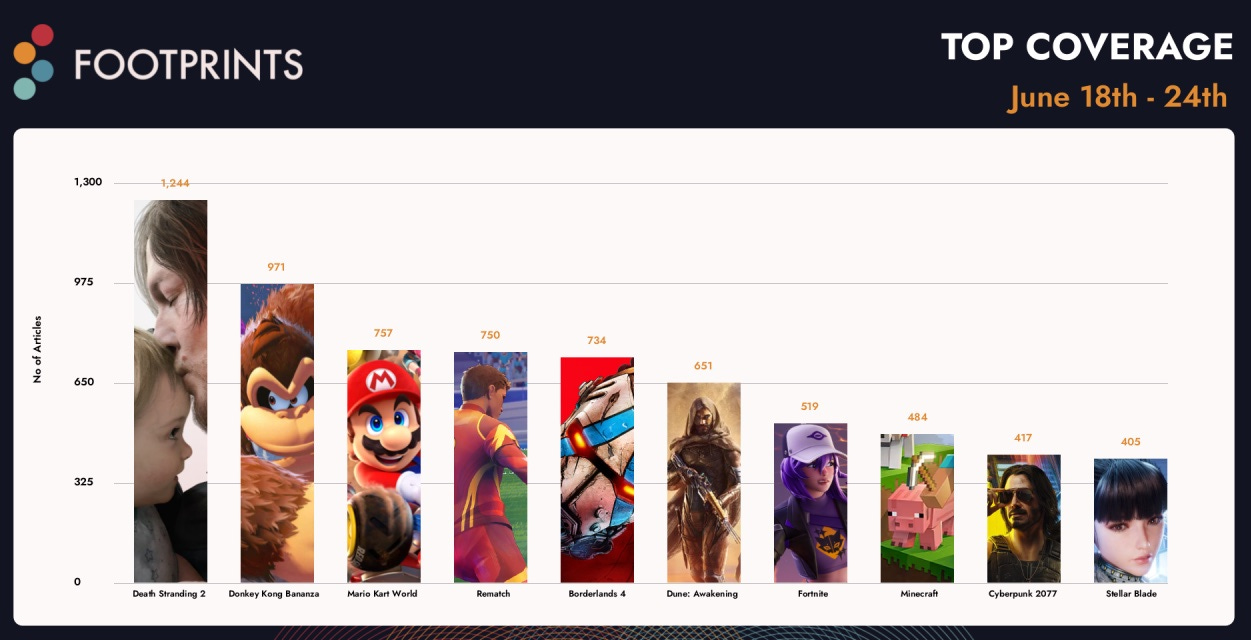

Looking at Footprints.gg’s ‘trad media’ coverage chart up to June 24th (above), Hideo Kojima’s Death Stranding 2 - which released yesterday on PS5 - tops the charts, followed by Switch 2’s upcoming Donkey Kong Bananza (thanks to its Nintendo Direct), Mario Kart World, Rematch, and Borderlands 4.

A Redditor analyzed every single Steam game released on one day, and after 16 days: “~0 copies sold: 13 games, <$500 gross revenue: 18 games, $500 – $2,500: 10 games, $5,000 – $20,000: 10 games, >$20,000 gross revenue: 2 games.” Conclusion: “Genre choice is a game changer… Small, focused games in the right niche are the big winners.”

Game File’s interview with a PlayStation Network exec had some interesting tidbits. For one: “81% of PS Plus subscribers own a PS5, up from 70% a year ago.” And for PS+ as a platform: “Finding four or five independent day-and-date titles [per year] and… bringing [other] games in when they're 12, 18 months old or older” will continue.

After announcing it for the EU and Canada a couple of months back, Humble Choice has increased the price of its ‘multiple Steam keys per month’ PC subscription service to $14.99/month (formerly $11.99) and $154.99/year (formerly $129) in the U.S.. More details on regional changes here.

Roblox has made a major payout algorithm change for devs, launching a new, transparent ‘Creator Rewards’ program - separate to IAP Robux monetization. Brendan Stock thinks it’s a play for Fortnite creators, tho we’re guessing it’s been a bit controversial with bigger devs so far, judging by a detailed FAQ update.

Microlinks: PlayStation Plus’ ‘monthly’ basic-tier games for July are Diablo IV, King Of Fighters XV and Jusant; Netflix is removing over 20 games, including Hades and Monument Valley; aspiring game developers in Fortnite and Roblox keep suing each other ($).

A small update from Tuesday’s ‘top Discords’ newsletter: Grow A Garden’s Janzen Madsen pinged us to note that his game’s Discord server isn’t part of Discord Server Discovery, but has 550k+ actives (wow!) So yes, there are big ‘unverified’ servers not part of Tuesday’s charts, since Discord Verify is down & Discord will quietly boost your server sometimes if you’re boomin’, even if not ‘verified’.

Game dev budget numbers are rare, but IO (Hitman) spilled some - roughly - in this Game Business interview: “Without being too precise, Hitman 2016… let's say it was a $100 million game. Hitman 2 was maybe $60 million. [2021’s] Hitman 3 was $20 million [to create]. And Hitman 3 was the highest Metacritic.” Iteration… good?

Thanks to a new Steamworks sales data API, it’ll be much easier for Steam devs to grab their own sales data programmatically going forward. (Some third-party providers are heavy on the HTML scraping, so this may be Valve’s reaction?) The new API also adds more detailed key activation reporting on third-party keys.

The Verge’s Tom Warren has some good musings ($) on Xbox’s evolution: “It’s an ambitious vision where Xbox games can be played across multiple devices, all with cloud saves… It’s also a clear reaction to SteamOS and the fact that OEMs are starting to show interest in Valve’s efforts to span its game library across console-like devices.”

It hasn’t been discussed a lot, but Canada’s Digital Services Tax (DST), which implements a 3% tax on “certain revenue earned from engaging with online users in Canada”, has its first payments due at the end of June, and we think Valve is eligible. (This is a tax Steam will pay on Canada-sold games, not devs, but…)

Microlinks: more people are ‘group suing’ game platforms under consumer law outside the U.S., with PlayStation being targeted in the Netherlands; Newzoo’s latest 2025 games market report has it at $188.9 billion (+3.4% YoY); Steam is improving localized image and over-ride management for your store pages.

Which genres have 'ruled' Steam? A new view…

A few months ago, we at GameDiscoverCo were musing on that scariest of words - ‘taxonomy’. Specifically: while we love Steam tags and use them extensively in our GameDiscoverCo Pro (and Plus) SaaS products, they’re overlapping. So this means you can’t really get a good idea of market size/make-up, because games use lots of tags.

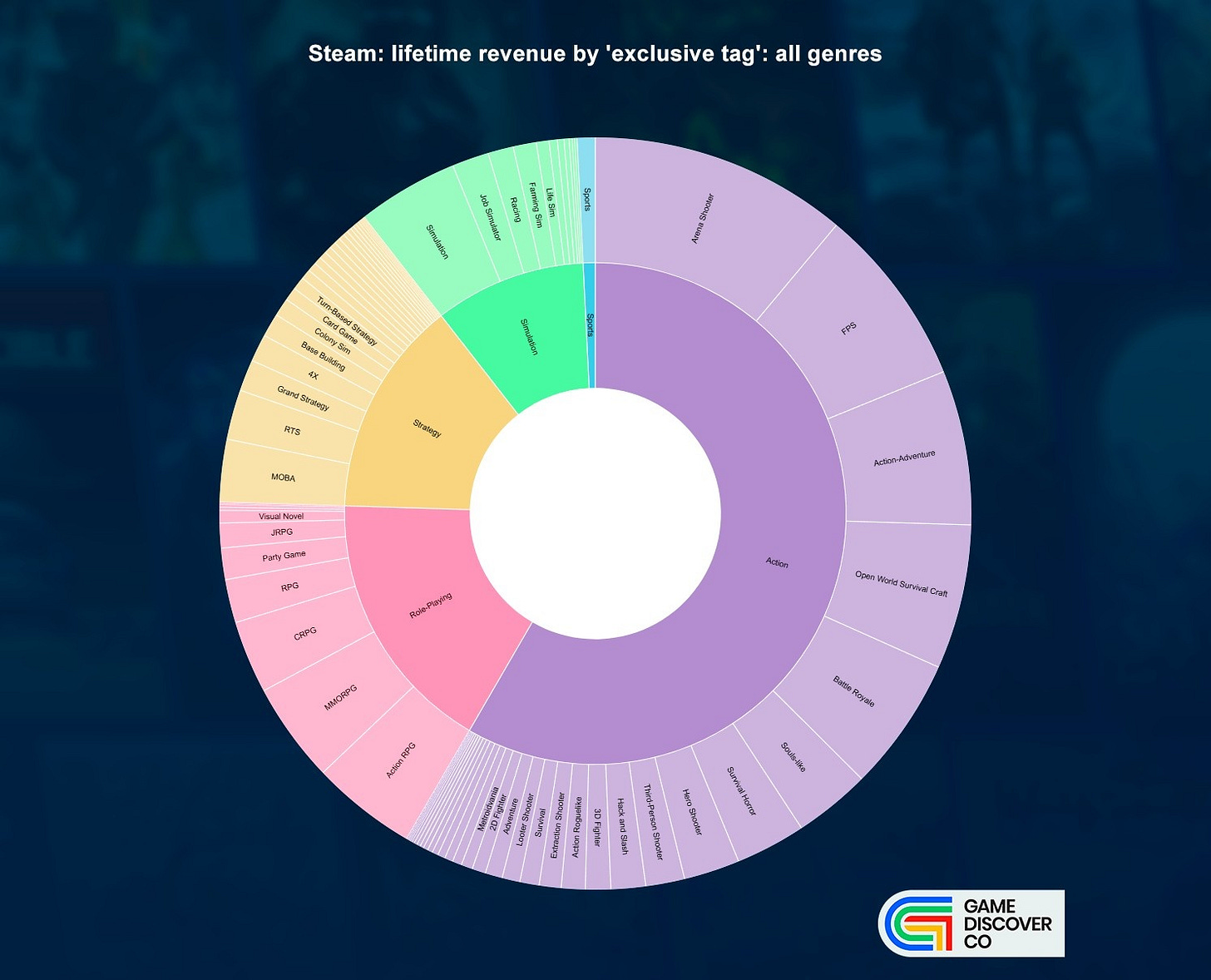

So we dared to dream - what if we could assign only one genre and one subgenre tag for all Steam games which have grossed >$1 million? Wouldn’t we be able to see a real TAM (total addressable market) chart for Steam’s entire history? Well, that’s just what we did, and we’re presenting you GDCo’s results of our ‘exclusive tag’ research.

This raw data’s available to GDCo Pro subscribers in the ‘exclusive tag browser’ section, and we’re intending to improve and expand it in the medium-term. (It’ll be useful to see granular trends on a month/year basis, rather than just ‘all history’.)

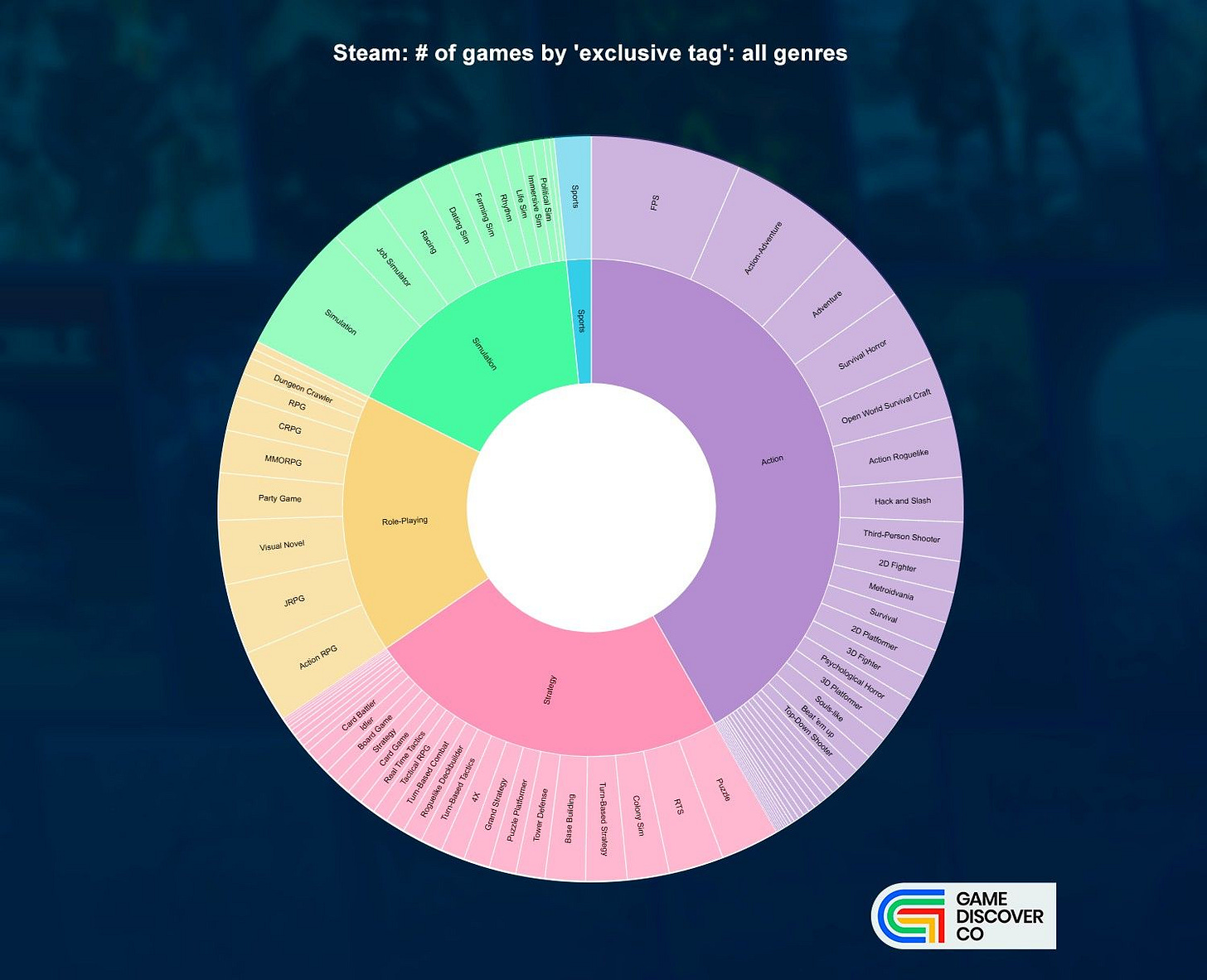

But for now, the genre splits by all-time Steam revenue are: Action (58.37% of total), Role-Playing (17.11% of total), Strategy (13.97% of total), Simulation (9.76% of total) - and Sports the remaining percentage! And for reference, here’s the split by # of games:

We’ll get into ‘average revenue per game’ more at the end. But if you compare the two charts, it implies that ‘Action’ - thanks to a few standout ‘evergreen’ titles - is punching above its weight in Steam revenue on a per-game basis.

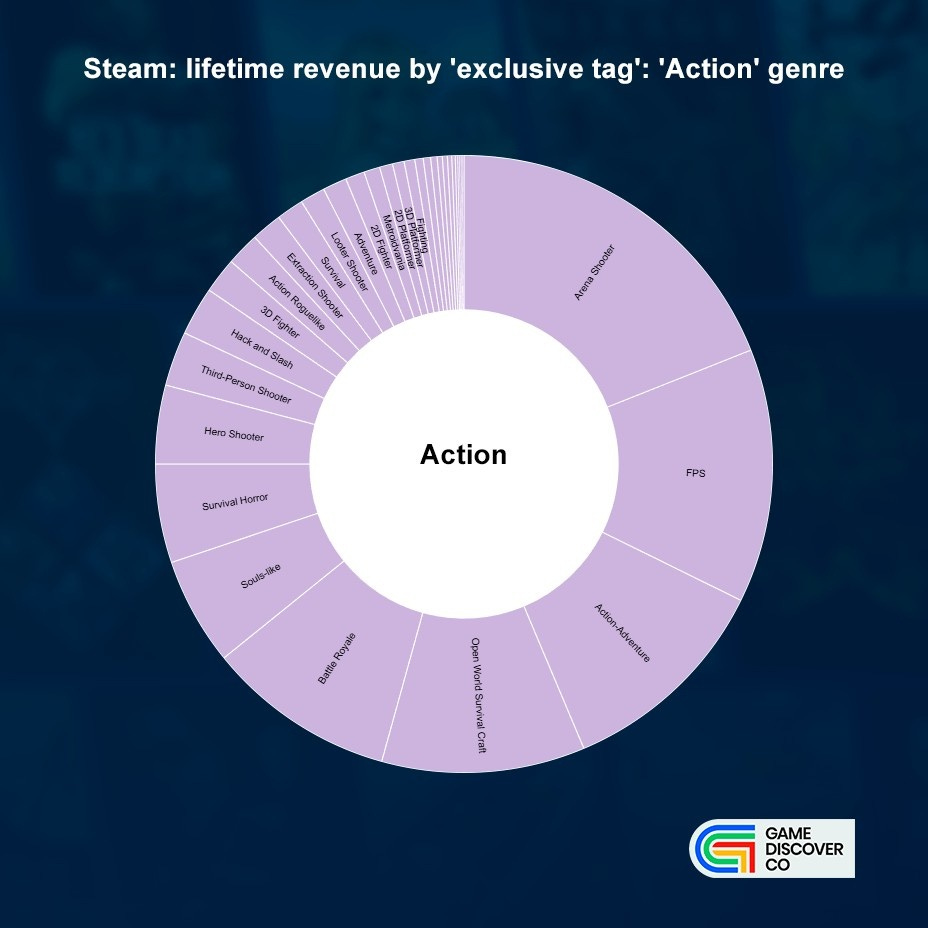

Anyhow, we figured it would be good to dip into the top subgenres* for each genre, methodically. (*’one subgenre per game’ is never going to be definitionally perfect, btw - we’ve done our best!) And here we go, starting with Action:

The ‘Action’ genre is 58.37% of total Steam revenue, despite being significantly less than 50% of the >$1 million LTD (lifetime to date) games, and makes up the following:

Arena Shooter (18.99% of Action, combined revenue: $9.52 billion LTD, standouts: Counter-Strike 2, Counter-Strike: Source - mainly the former!)

FPS (13.30% of Action, combined revenue: $6.67B LTD, standouts: Call of Duty, Left 4 Dead 2, Ready or Not.)

Action-Adventure (11.37% of Action, combined revenue: $5.70B LTD, standouts: Red Dead Redemption 2, Hogwarts Legacy, Sea of Thieves.)

Open World Survival Craft (10.65% of Action, combined revenue: $5.34B LTD, standouts: Rust, ARK: Survival Evolved, Palworld.)

Other key subgenres: Battle Royale (9.89%), Souls-like (5.65%), Survival Horror (5.17%), Hero Shooter (4.12%), Third-Person Shooter (2.86%), Hack and Slash (2.55%).

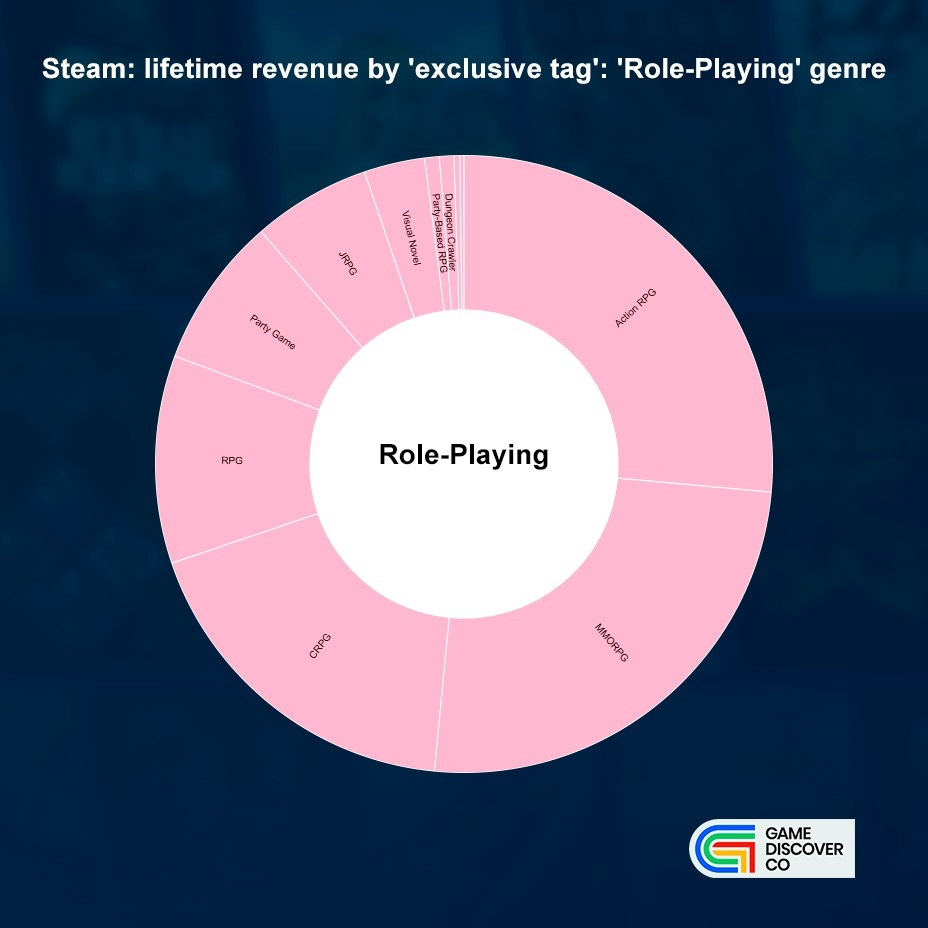

Next, we have Role-Playing, which is 17.11% of total Steam revenue. Obviously, subgenres like ‘Action RPG’ span multiple genres, but we chose to put ARPG here:

Action RPG (26.45% of Role-Playing, combined revenue: $3.89B LTD, standouts: Warframe, Monster Hunter World, Monster Hunter Wilds)

MMORPG (25.08% of Role-Playing, combined revenue: $3.69B LTD, standouts: The Elder Scrolls Online, Lost Ark)

CRPG (18.26% of Role-Playing, combined revenue: $2.69B LTD, standouts: Cyberpunk 2077, The Witcher 3: Wild Hunt, Fallout 4)

RPG (10.89% of Role-Playing, combined revenue: $1.60B LTD, standouts: Divinity: Original Sin 2 - Definitive Edition, Kingdom Come: Deliverance)

Other key subgenres: Party Game (7.89%), JRPG (6.20%), Visual Novel (3.18%) Party-Based RPG (0.76%), Dungeon Crawler (0.76%), Strategy RPG (0.30%)

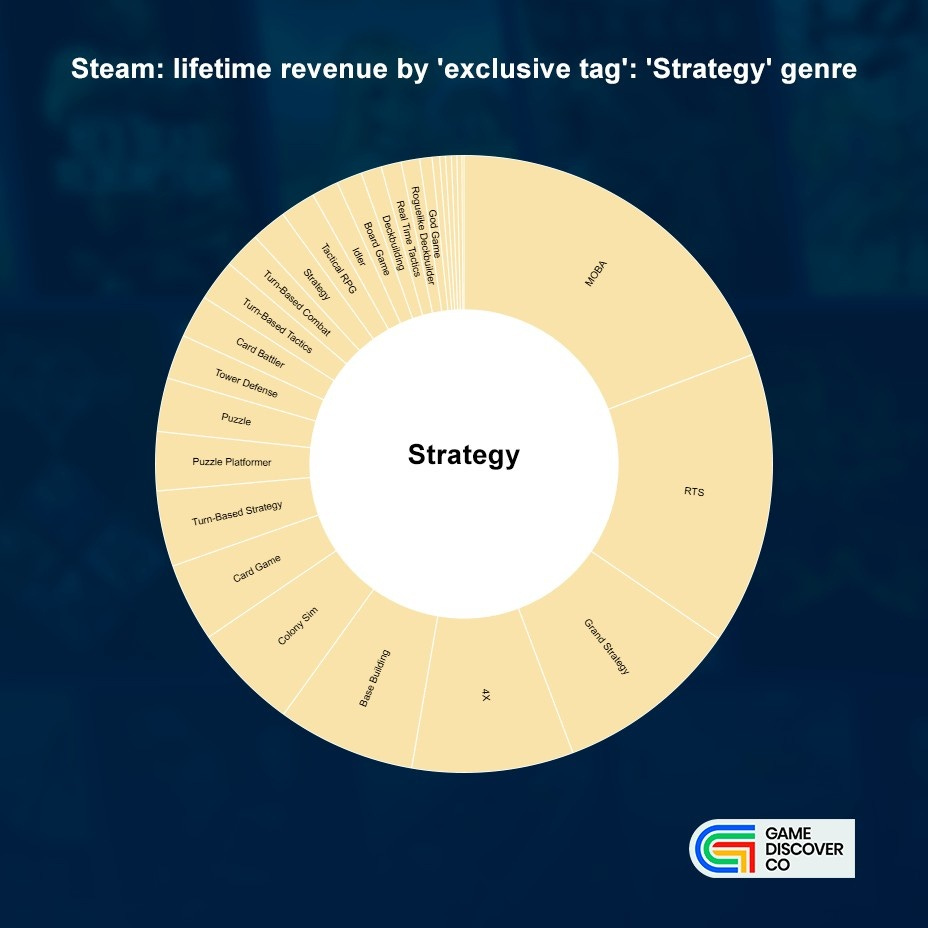

Next, we have Strategy, which is 13.97% of total Steam lifetime revenue as an overarching genre. Specifically:

MOBA (19.23% of Strategy, combined revenue: $2.31B LTD, standouts: DOTA 2, SMITE, Eternal Return)

RTS (15.33% of Strategy, combined revenue: $1.84B LTD, standouts: Total War: Warhammer II, Total War: Warhammer, Total War: Three Kingdoms)

Grand Strategy (9.70% of Strategy, combined revenue: $1.16B LTD, standouts: Stellaris, Hearts of Iron IV, Europa Universalis IV)

4X (8.45% of Strategy, combined revenue: $1.01B LTD, standouts: Sid Meier’s Civilization VI, Sid Meier’s Civilization V, Endless Legend)

Other key subgenres: Base Building (7.22%), Colony Sim (5.58%), Card Game (4.12%), Turn-Based Strategy (3.96%), Puzzle Platformer (3.09%), Puzzle (2.80%)

Finally, we have Simulation, which is 9.76% of the total Steam revenue, and consists of the following - some of these subgenres being not easily subdividable:

Simulation (44.57% of Simulation, combined revenue: $3.74B LTD, standouts: War Thunder, Arma 3, Cities: Skylines)

Job Simulator (16.21% of Simulation, combined revenue: $1.36B LTD, standouts: Euro Truck Simulator 2, American Truck Simulator, Schedule I)

Racing (11.24% of Simulation, combined revenue: $942.89M LTD, standouts: Forza Horizon 5, Assetto Corsa, Need for Speed Heat)

Farming Sim (10.15% of Simulation, combined revenue: $851.29M LTD, standouts: Stardew Valley, Farming Simulator 22, Farming Simulator 19)

Other key subgenres: Life Sim (5.59%), Rhythm (3.63%), Dating Sim (2.92%), Immersive Sim (2.23%) ,Political Sim (1.30%), Walking Simulator (1.09%)

So far, so good. And this data - which we don’t think anyone has attempted before - is great just for getting a ‘mind map’ of Steam/PC games’ fertile areas. But there are massive caveats here if you just use this map to jump in and target genres!

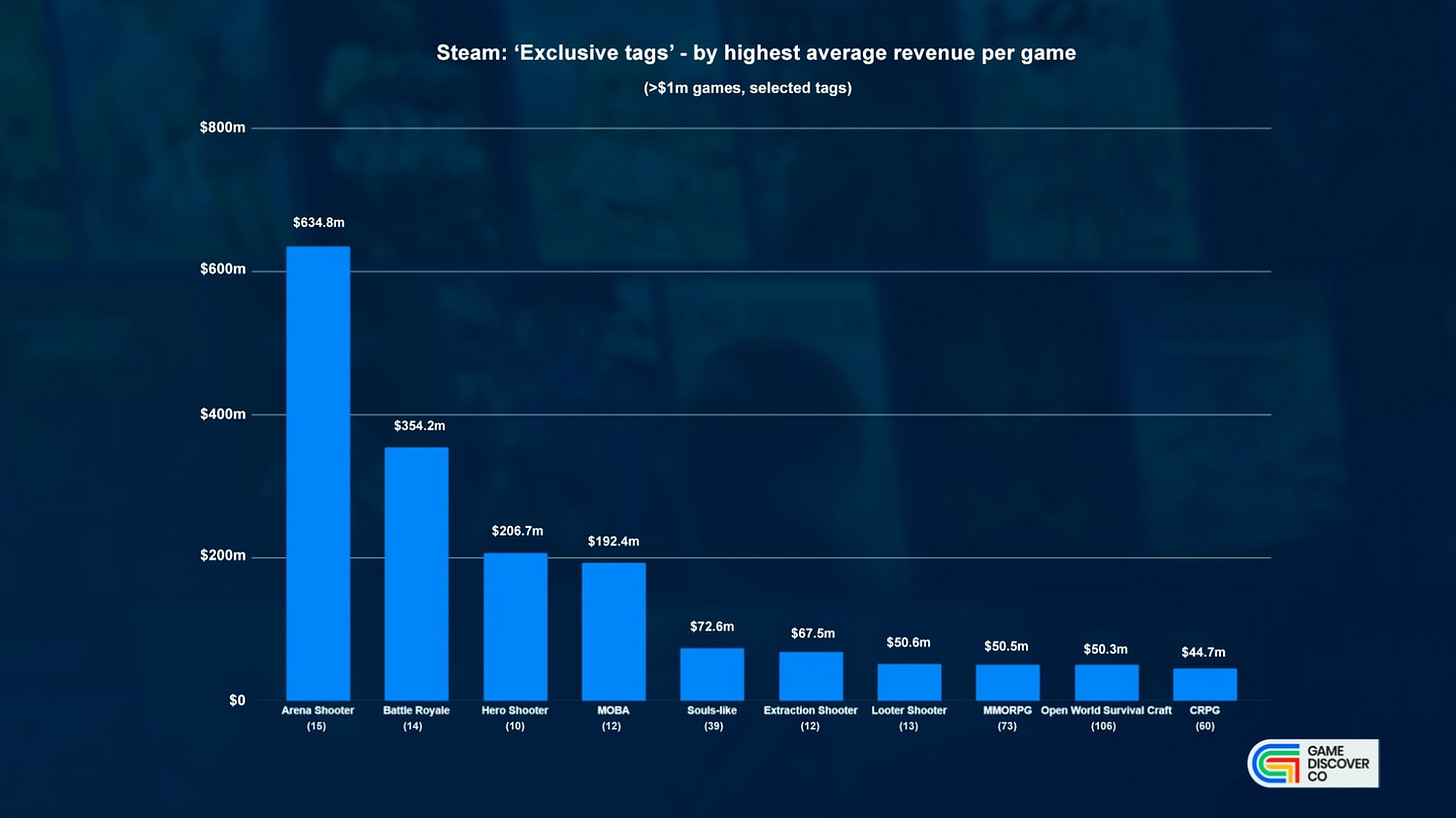

Why, because some of the bigger genres are dominated by a handful of games, many of which have been on sale for approaching a decade or more. In order to see that, let’s do something basic. Look at ‘highest average revenue per game’ on a tag-by-tag basis:

So yes, genres like Arena Shooter, Battle Royale, and Hero Shooter look amazing from a revenue perspective. But there’s only 29 games in all of Steam’s history that have grossed >$1m in those subgenres. (And only Naraka Bladepoint, Overwatch 2 & Marvel Rivals have grossed >$25m and launched since 2020 in those subgenres. Wow.)

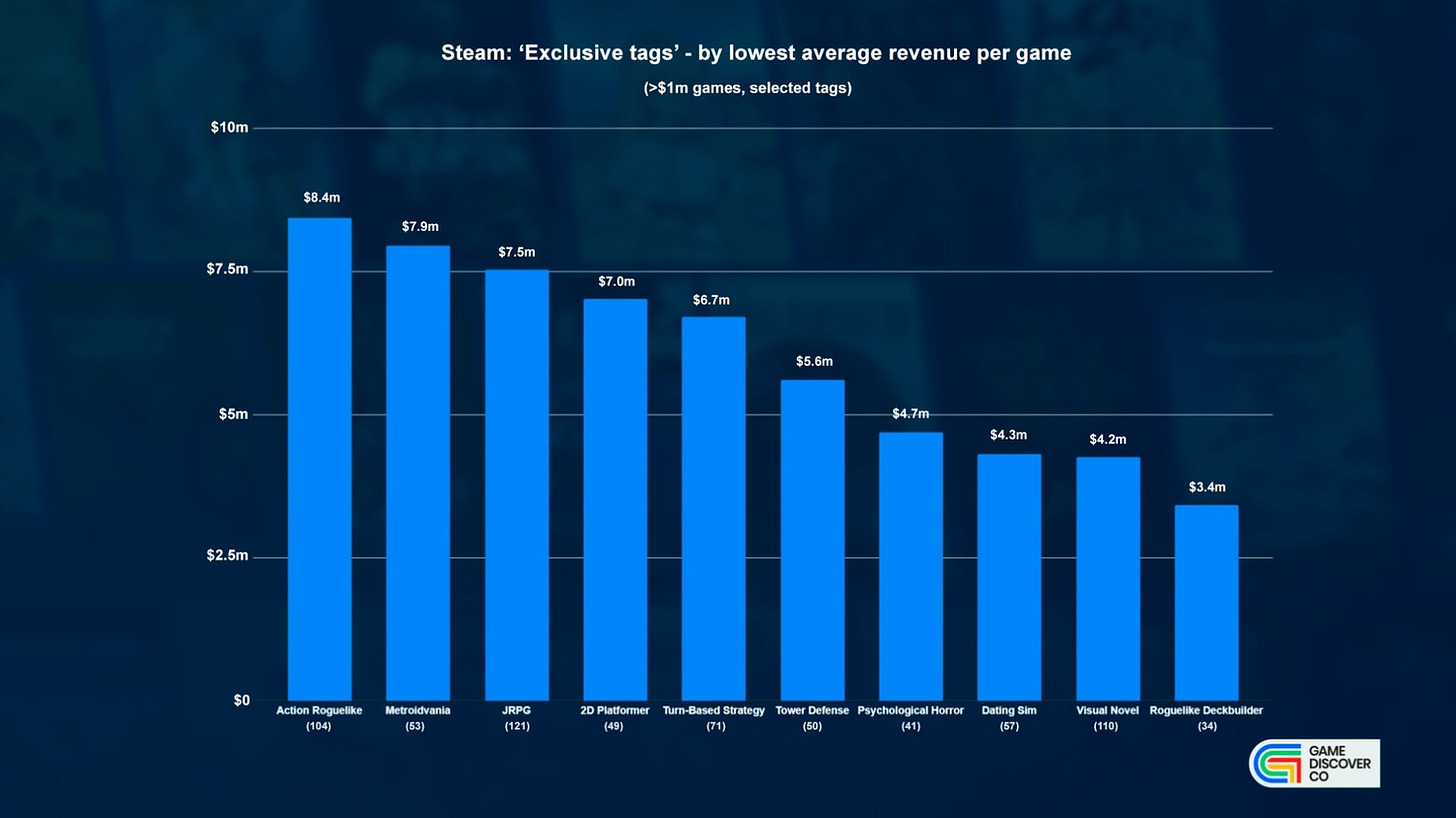

On the other hand, here’s the games with the lowest average revenue per game - reminding that this is lifetime revenue for games that have grossed >$1m lifetime:

These are much healthier subgenres in terms of number of games that made it past $1 million, including Action Roguelike (104 games), Psychological Horror (44 games), and JRPG (121 games). And a greater % of the titles are more recent - over 70 of the 104 games in Action Roguelike were released since 2020. (It’s a newer genre, tho…)

Caveat: only looking at games that grossed >$1m means that we are cutting out the thousands of competitors at lower revenue levels in these genres. So it’s not as easy as just picking from this list with a lower dev cost and going for it, either.

So yes, data doesn’t solve problems - it often creates more questions. But this level of specificity does give you genuine insight on market make-up. And it’s probably important to understand where we’re at, if you’re making small or big market bets…