What Grow A Garden's 8.9 million CCU (?!) tells us about game discovery

Also: lots of news & some Instagram Reels analysis....

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Ye gods, is it time to get another lengthy newsletter from us again? We’re afraid so. And this time, we get deep into the latest Roblox game sensation to understand - where did it come from, and does it really have that many simultaneous players?

Before we start, the Play History folks have spotted a short .JP YouTube video on the making of Namco’s 1985 arcade game Metro-Cross, and as they note, it’s “some of the BEST behind-the-scenes I've seen from this era….You get pixel art, music, and even showing an incomplete build! This is rare stuff.” (There’s also a lot of smoking during meetings.)

Game discovery news: Warhammer games trend..

Starting out the week in style, let’s take a look at a whole variety of game platform & discovery news, as follows:

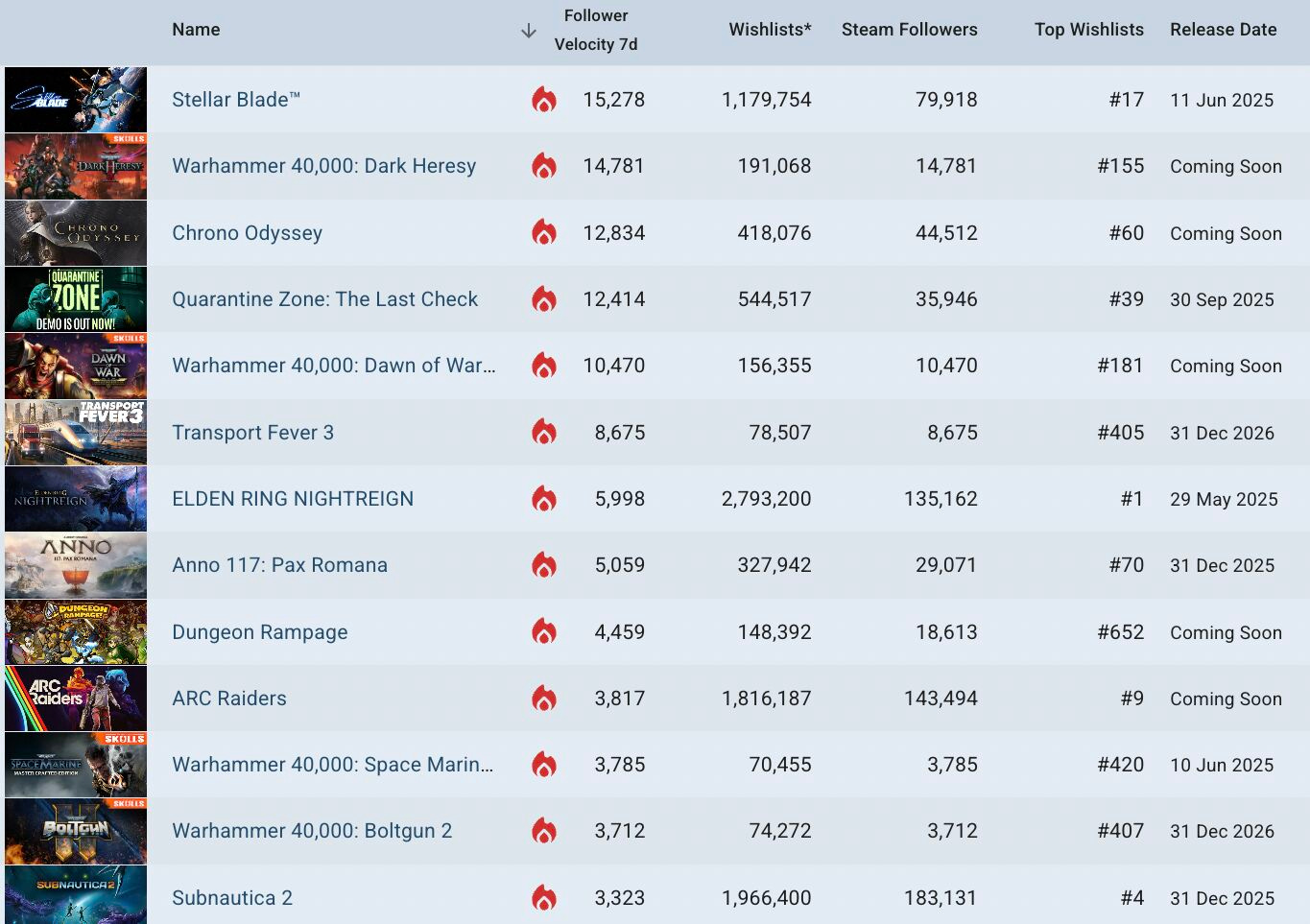

Looking at GDCo's countdown of 'trending' unreleased Steam games by 7-day new followers, the Warhammer Skulls Showcase charted four titles: Owlcat's CRPG Warhammer 40k: Dark Heresy (#2), remasters of 2004's RTS Dawn Of War (#5), 2011's ARPG Space Marine (#11), & boomer shooter follow-up Boltgun 2 (#12).

Besides the 'usual suspects' (Stellar Blade at #1, Quarantine Zone: The Last Check at #4), ambitious UE5 MMO Chrono Odyssey (#2) had gameplay & upcoming beta access, and Ubisoft's Roman city-builder Anno 117: Pax Romana (#8) also trended on new gameplay. A new entry? Transport Fever 3 (#6), for Germans & others too!

Hidden Folks creator Adriaan de Jongh has had it with ‘explainer’ clickbait: “headline: ‘how [game] sold [high number] in just one week!’ my mind: 20% trying everything, 80% luck article: (lies) 100% intentional and reproducible.” It’s true a LOT of success is luck, folks, as Rami Ismail echoes. (Though we still think being in the right place at the right time, genre and execution-wise, improves your ‘luck’.)

Here’s a good compatibility overview of the ‘new era’ of SteamOS. Its current AMD chipset focus means it “doesn't make SteamOS a drop-in replacement for Windows - without strong support for Intel or Nvidia hardware, it's not a great candidate for the majority of gaming PCs.” But it’s def. expanding compatibility over time...

Sony’s big Days Of Play promo includes cheaper pricing (from $399 in the U.S.) on a new PlayStation 5 Black Ops 6 hardware bundle, as well as new PlayStation Plus ‘monthly’ (NBA 2K5, Destiny 2: The Final Shape) and Game Catalog (Another Crab’s Treasure, Skull and Bones) titles. (Oh, and Myst & Riven for PS+ Classics!)

Streaming showcase fans, the Six One Indie showcase just happened, and RockPaperShotgun has a round-up of some of the most interesting games, including Jump the Track, which “mixes choice based visual novels with

Pegglepachinko.” Mm, Peggle…StreamElements & Rainmaker.gg debuted their state of Twitch data for April, noting ‘only’ 52m hours watched daily in April - down from 57m in Jan/Feb. Also notable: “Call of Duty: Warzone experiencing a whopping 146% surge in viewership on Twitch, driven by the return of an updated version of the fan favorite Verdansk map.”

GI.biz did a giant interview with Clair Obscur’s dev and publisher which at least clarifies the size of the core dev team: “We started with less than 10 people, scaled up until 30, and close to 40, and then scaled a little bit down.” There’s also discussion on the game “respecting the player’s time”, and its ‘in-between’ $50 pricing.

Switch 2 tidbits: the new console’s GameChat audio/video chat feature will need a phone number registered to use it; Nintendo's anti-scalper measures hit Japan, with Yahoo Auctions banning all Switch 2 console listings. (Other Japanese resale sites are banning pre-release sales or requiring ID checks.)

Microlinks: Valve CEO Gabe Newell’s Neuralink competitor is expecting its first brain chip this year; a good overview on how global digital service tariffs could still escalate from U.S. physical tariffs; a YouTuber compares the Windows and SteamOS versions of the Lenovo Legion Go, showing 5-15% FPS performance improvements on SteamOS with similar wattage. (And battery life is better.)

What Grow A Garden’s 8.9m CCU sez on discovery

Sometimes it feels like Roblox - as an ecosystem - exists on a whole different planet to traditional PC and console games. I’m reminded of Leonard Richardson’s novel ‘Constellation Games’, which is built around the conceit that the protagonist is learning about the culture of aliens from… playing their video games.

But once again, GameDiscoverCo is peeking over the fence from the outside, given the news that the Roblox gardening (and pet!) sim Grow A Garden hit 8.9 million concurrent users over the weekend. (Even before that, it was more than the Top 100 Steam CCUs combined.)

You can keep up with the game’s CCU stats on third-party trackers like Rolimons, where you can see that Saturday’s spike was related to a limited-time ‘Monster Mash World Record’ event, but the game is regularly pulling 1.5-2.5m CCUs at all times:

This surge comes alongside a continued flood of Roblox experiences, the vast majority fan-created. Roblox data-powered game studio Offpath's founder Tim Elliott tells us that there are ~2,000 new Roblox experiences launched every day. And over the past year, only 1 in 50,000 will reach (even for just a day) the Top 10 by player spend.

So Grow A Garden is huge. Can we look at it beyond CCU, though? Offpath's Elliott tells GDCo: “The problem with CCUs is that we fixate on the peaks, even if they're fleeting. Hours played is a much better measure of engagement. Monetization is equally important, since many high CCU games have very low ARPUs.” (He estimates that, for example, Adopt Me might currently have an ARPU that's ~5x higher than Brookhaven.)

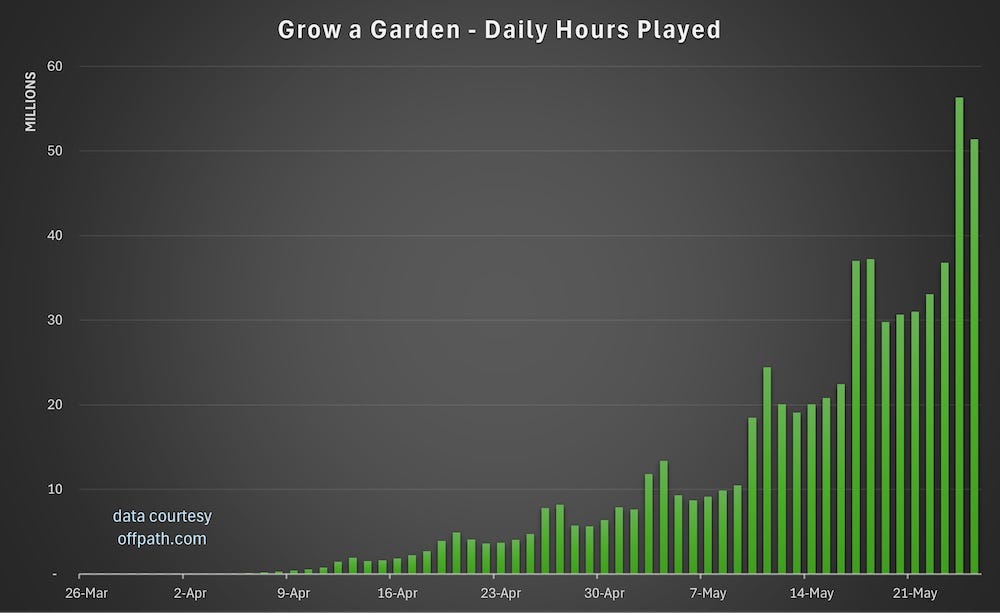

There seem to have been rumors of bots especially swelling Grow A Garden’s numbers - but we don’t see it. There’s just a massive groundswell of organic interest - here’s some ‘hours played’ estimates via Offpath:

Those numbers are real, and spectacular. So when even Eurogamer is running stories on ‘how to get a Bloodlit mutation fruit in Grow A Garden’, let’s take this phenomenon seriously, even as YouTubers make viral videos ranting about the game being so popular, and ask - why?

Luckily, the folks at Roblox HQ connected us to Janzen ‘Jandel’ Madsen, who heads up the remote-first Splitting Point Studios team out of New Zealand, and acquired, improved, and scaled Grow A Garden. Janzen is a creator who has a great reputation for finding, growing and improving games in the Roblox ecosystem.

Janzen told us Splitting Point has 19 devs, and ~10 billion total visits across a multitude of games, including three titles with >1 billion visits. The dev’s other top games include Roblox award-winning FPS Gunfight Arena (750m visits), and ‘moving base’ car scavenger A Dusty Trip (1.6b visits.)

This gets us to our first revelation: like a combo of indie publisher and co-developer, many of the newer viral titles on Roblox have been acquired very early on by savvy operators who understand how to improve, scale and monetize them. (Another example: Do Big Studios, who are a quiet co-publisher in Grow a Garden and also scaled fishing game Fisch, which has 3 billion visits and maxed out at >500k CCU.)

Janzen told us: “We started working on Grow a Garden when the game had around 1,000 CCUs.” It looks like the original creator of the game - an edgy teen called BMWLux - wasn’t necessarily well-positioned to nurture and grow it, although he still contributes creatively to Grow A Garden. (We presume some titles are acquired for revshare, some for $, some for Robux, etc.)

Since the foundational idea of Grow A Garden appeared to have stellar retention and was poised to scale, Janzen told us: “We staffed the game with almost all our [dev] staff (around 12 people). We made key changes which helped the game scale. Lots of time was spent listening to feedback and trying to connect that back into future updates.”

So - some of impressive growth of Grow A Garden is, in part, ‘just’ great GaaS game scaling. Janzen and team are building out limited-time, well scheduled events, interesting powerups, and rare new plants & pets.

We also feel like the idea of a ‘weekly drop’ has been under-utilized in Roblox, with Janzen noting: “We update at 7am PST (2am in New Zealand!) every Saturday, and each week we’ve seen more and more people show up to celebrate the launch of the update and receive their celebratory update gift.”

Roblox also continually tweaks its discovery & recommendation algorithms, and in the last year or two, more games with strong metrics have been ‘coming out of nowhere’ to do great on the platform. (We presume because Roblox is more agile & willing to promote titles with the right playtime and engagement - and social media virality?)

But beyond that, here’s some things that differentiate the game within Roblox:

Bringing the ‘offline’ paradigm to Roblox: As David Taylor noted on LinkedIn, there’s a reason the game’s icon says ‘Grows Offline’: “Offline is an innovative mechanic never seen before… [bringing] players back time and again to see what they grew.” You may be: not innovative? But it is for Roblox, where the idea that things happen while you’re not logged in is an alien concept. (It’s also a retention aid to Roblox as a platform, since you can play other games & come back.)

A universal, friendly (non-competitive) core game design: the idea of simply growing a garden sounds relaxing and non-threatening? And Janzen noted that while some Roblox games are more PvP and sharp-elbowed: “With Grow a Garden, the whole joy in playing is centered around something that isn’t inherently competitive.”

Incredibly simple, understandable starting point: In general, Janzen pointed out to us, Robox as a platform has “no time for tutorials [and] no time for world building - so it's a fundamentally different skillset and approach.” Given the simplicity of the interface for Grow A Garden, it’s literally a ‘kids from 6 to 99 get this’ proposition.

There’s still some point to a shared multiplayer world: you may think - why is this game even multiplayer? But having shared environments you can chat in key, and there are interesting game mechanics due to that. Janzen: “When I play, I see a lot of players with more developed gardens gifting valuable fruits to new players.”

But we have to be honest - this is a great example of the ‘you might not have predicted this’ trend being discussed earlier in the newsletter. Some games just attract people’s attentions in ways you would not have necessarily guessed. The smart part is finding the game, taking that (clever!) germ of an idea and running with it in the right way….

And a final conclusion that struck a nerve with us at GameDiscoverCo? We asked Janzen about what the conventional game biz misunderstands about Roblox, and he replied: “The notion of players ‘aging out’ of Roblox is just as silly as saying that users ‘age out’ of a platform like YouTube - they don’t.”

Isn’t this exactly the conversation the trad TV/movie industry is having right now? Many of them seem shocked that as they grow up, video-watchers don’t naturally transition from microdocumentaries about buying decommissioned police cars to, say, prestige HBO miniseries. So we all need to be wrapping our heads around how Roblox players see the universe, given that 98 million daily active users ain’t nothin…

Which games go viral on Instagram Reels & why?

Finally, some bonus data we’ve been looking at, after our analysis of viral social media on upcoming Steam game The Long Drive North highlighted the creator Mavitivo, whose Instagram Reel about that game hit 7.8 million views last October, helping the game amass >300k Steam wishlists so far, according to our estimates.

Mavitivo is putting out around 60 Reels per month (!), all of the ‘here’s a game - I’m going to explain/invent a hook for it’ variety. And so we looked at all of his Reels from Feb. 2024 to April 2025, and found the Top 25 by views (Google Drive doc) - with the Top 15 in the above image.

Why did we do this? (Besides my colleague Alejandro being obsessed with spreadsheets, of course.) Well, we wanted to see what type of games end up doing great on Instagram, and if they actually sell well! Here’s what we spotted:

Some high-concept titles don’t mesh well with depth or execution: the top-performing Reel, for Drunk Builder Simulator, didn’t end up with the game selling particularly well, because imprecise controls + Among Us-style gameplay just don’t make for a compelling title. (But the physics are hilariously viral!)

There’s a genre of viral-y games that ‘look’ good that we sometimes ignore: I’d never really looked at Slackers: Carts Of Glory until his Reel, but turns out this shopping cart racing game has sold nearly 100k units since last September - albeit very front-loaded. (The sales, not the shopping cart.)

It’s not just funny physics-y games in the mix - some established titles scale: some of these were due to the game already having interest - like the Hello Kitty Island Adventure Reel, after the Apple Arcade and before the ‘other platforms’ release. But it also reflects that the game is simply very attractive. (Also see: the Who’s Your Daddy? Reel, which has been creepy and viral for simply ages.)

I guess it’s reassuring to know that you can’t just make a physics-laden Only Up/Little Kitty Big City ‘fast follow’ and immediately have a hit - hi, Only Way Is Down, which ‘only’ sold 6,000 copies so far. (So execution still matters.) But you should also be aware that the Reel based on it got almost 5 million views. Which is, uhh, a lot.

So in the absence of concrete takeaways, we suggest you at least look around those top-viewed 25 Reels among the 800+ we looked at, and ask yourself - why, and can my game do any of the things that those games do, visual attractiveness/meme-wise?

[We’re GameDiscoverCo, an analysis firm based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide real-time data services for publishers, funds, and other smart game industry folks.]

how does an "hours played" graph prove the lack of bots in the game?