What discovery trends can we learn from Devolver?

Also: some big wins for Oblivion and Clair Obscur this week & lots of news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Well, we had a choice of possible headlines for today’s GDCo newsletter, given there’s two big hit RPGs stomping all over the Steam charts right now. But we’ll leave the ‘new game performance’ trends to later - in the section Plus and Pro subscribers get access to - and make our lead story about key strategies from an indie publisher.

Before we kick off, this video on returning to early metaverse platform There.com has gone truly viral - ~6m views in ~12 days. But it’s a wonderful look at a ‘dead game’ that’s much more heartwarming than you might think - small communities ftw?

News: ‘games as platforms’ add… Darth Jar Jar?

Let’s get going here - and you may not be surprised to learn that we have a fair amount of news for you, this fair Friday:

IP crossover onto ‘games as platforms’ seems to be getting ever wackier, as titles increase the novelty value to grab attention. Two examples? Kevin Smith’s Bluntman & Chronic ‘superheroes’ x Call Of Duty, and, of course, the evil Sith overlord Darth Jar Jar x Fortnite, as part of a new Star Wars season in Fortnite.

March 2025’s Circana U.S. game hardware & software charts has total spending down 6% to $4.7 billion, though “Assassin’s Creed: Shadows was the best-selling title in March, instantly becoming the 2nd best-selling game of 2025 year-to-date.” Video game hardware? Down 25% to $286 million - and the lowest March spending since 2019.

Steam has announced an extensive set of opt-in accessibility tags - everything from adjustable difficulty through narrated game menus to mouse only options. Devs should start adding these now “as part of the 'edit store' section for each game in Steamworks”, and they will be rolled out to players later in 2025.

The unmissable analyst Doug Shapiro talks about ‘price deflation in media’ , noting: “Monetization per hour is often hard to calculate and therefore overlooked, but it’s a valuable measure of the relative value of different media or to track the health of media over time.” (Wonder how this stat has changed for PC games over time?)

We know Switch 2 demand is high - and Nintendo president Shuntaro Furukawa “explained around 2.2 million people in Japan are attempting to secure a Switch 2 through the My Nintendo Store.” But you had to have subscribed to Switch Online for at least 12 months & played >50 hours on Switch to even qualify! (So: very high.)

New funder Blue Ocean Games has introduced the v.neat Steam Tag Surveyor dashboard with Ichiro from Totally Human Media - it’s located here, and is designed to answer questions like "How has the Fighting + Physics… combo performed over the past 10 years?" or "What tags most often appear alongside Tactical RPGs?".

Microlinks: how Roblox creators, studios, and Roblox itself are confusing advertisers over ad opportunities; Epic weighs in after Apple is fined €500m for DMA breach in the EU for not fully allowing ‘alternative distribution’ on iOS; some new academic research on the benefit of console subscription models (via Konvoy.)

We know the ‘friend pass’ idea from games like It Takes Two, of course. (It’s a free copy that can play co-op alongside a paid player.) But it’s interesting to see Lords Of The Fallen add it alongside a ‘2.0 update’. Could this be a new discovery angle to unlock ‘long tail’ revenue?

Switch 2 things: Digital Foundry finally got to a tech overview of Switch 2, saying “from our perspective, the hardware hits the spot: bigger, brighter, better”; hardly any Switch 2 launch physical titles are using ‘real’ cartridges, rather Game Key-Cards (or digital only); Switch 2 Edition upgrade packs are $20 for some first party-games like Mario Party & Kirby - and $10 for others & some third-parties.

Two good opinion pieces: Paul Kilduff-Taylor on why “hunting wishlists is making indie games boring - time to get weird”; and Matt Hackett on 3 key game success metrics: “🎮 It's all about your game; 🎁 The packaging is important; 📢 Influencers need to love it.”

As spotted by UploadVR: “Meta has revealed the 50 best-selling paid Quest games of all time in a new section of Quest's Horizon Store.” Beat Saber is #1, followed by Job Simulator and Superhot VR: “Other classic titles in the top 10 include The Thrill of the Fight, Onward, and Vader Immortal Episode 1, while Blade & Sorcery: Nomad is #4.”

Esoteric - but relevant - microlinks: Mark Zuckerberg says social media is over, in an “under-recognized shift away from interpersonal communication”; cost of living alert - movies and TV productions are rapidly leaving California to film outside the U.S; a rare look at the ‘Taito x Valve’ Japanese Left 4 Dead arcade machine.

Discovery trends we can learn from Devolver?

Now, I’m sure all of you have had plenty of time this week to look at Devolver Digital’s 32-page investor presentation on its 2024 results, and the related 84-page annual report. What, you haven’t? See us after class! And fine, fine, we’ll do it for you, then…

In all seriousness, because Devolver stock is traded on the UK’s AIM submarket of the London Stock Exchange, there’s fairly stringent public reporting responsibilities. So this means there’s a lot of strategy transparency. And the business did decently in 2024 - $104.8m in revenue & $5.1m in profit/EBITDA, with a cash balance of $41m.

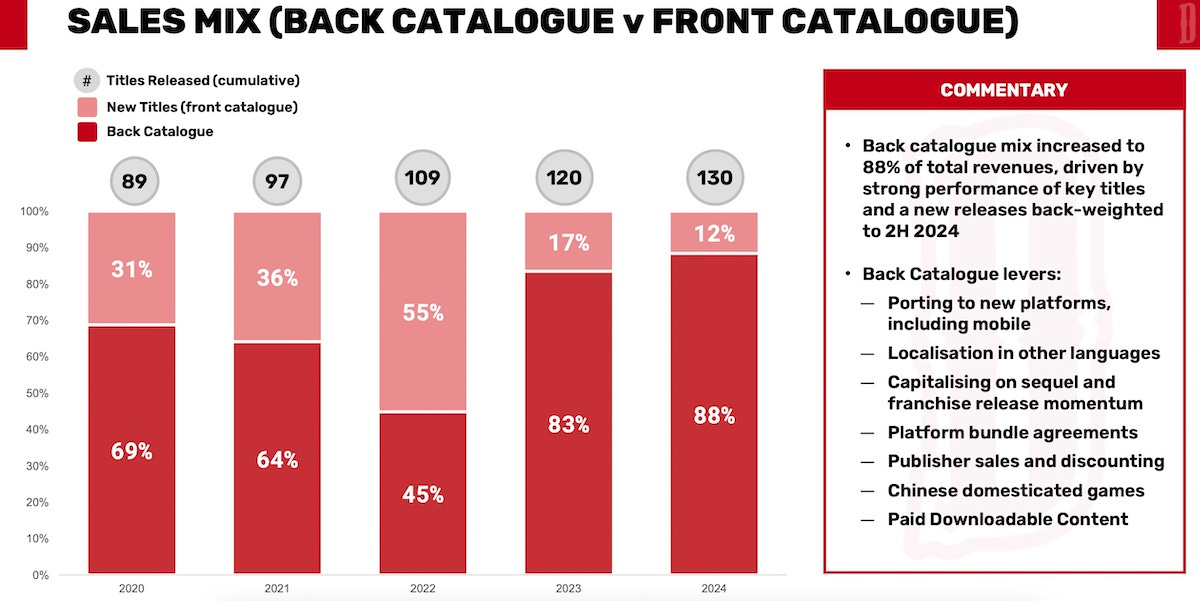

But how that number is made up brings us to our first discovery lesson. In a year that lacked a breakout new hit for Devolver, having a back catalog(ue) of games released before 2024 and efficiently leveraging it was key to revenue robustness:

What’s more, Devolver has recognized that - besides porting and publisher sales - pushing for more ‘expandable’ games and more DLC for their existing hits is key. The company notes, as part of its annual report:

“Planned investment into new expandable games [is] increasing by nearly 70% between 2024 and 2026 and investment into expandable content for already launched games (DLC etc.) planned to increase by nearly 65% between 2024 and 2025.”

It notes “standout PDLC [paid DLC] success for Astroneer and Cult of the Lamb” as a key driver for back catalog sales up 20% YoY, with a 280% revenue increase for Cult Of The Lamb in the month around its Pilgrim Pack DLC, and a 900% MoM increase in Astroneer revenue - best sales day since EA launch - thanks to the Glitchwalkers DLC.

It’s interesting that Glitchwalkers DLC is not that well-received by some core players - only 42% Positive user reviews - but still skyrocketed revenue. But perhaps the point of DLC is as much exposing new people to the game - and letting them buy a discounted ‘deluxe edition’ pack - as it is delighting existing fans? (Both is good, tho!)

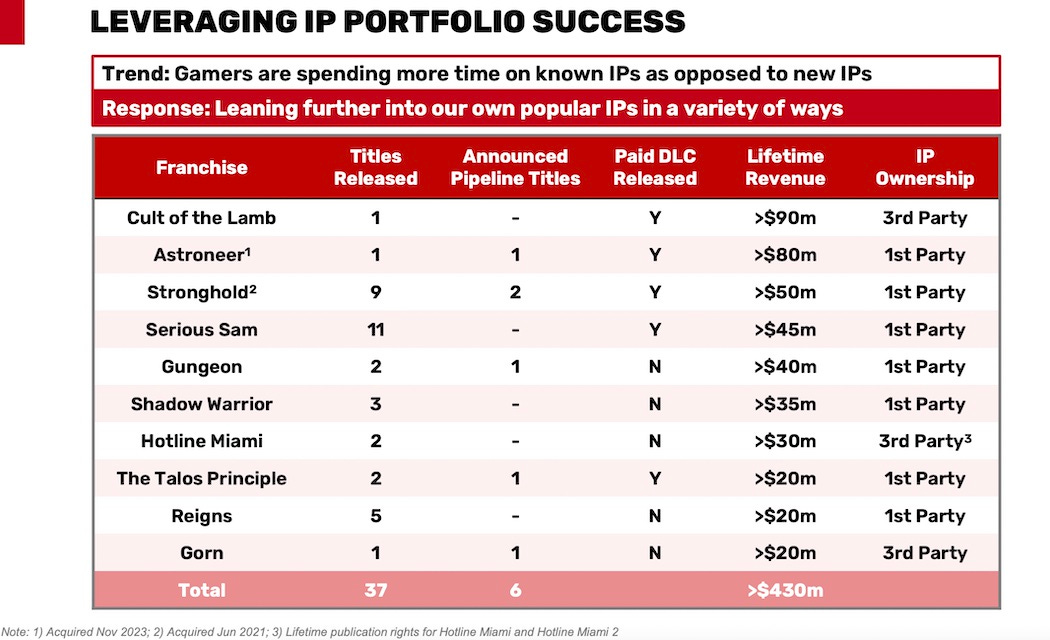

While we don’t get to see the performance of all old & new titles, the results do pick out some key franchises (above) - many of which are now wholly owned by Devolver. And it looks like franchise building is what the company is concentrating on.

This makes a lot of sense, given the crowded and unreliable ROI for brand new titles in today’s market. (Of course, it’s not a luxury that all companies can rely upon, because not all of us have hit game franchises up the wazoo, but hey.)

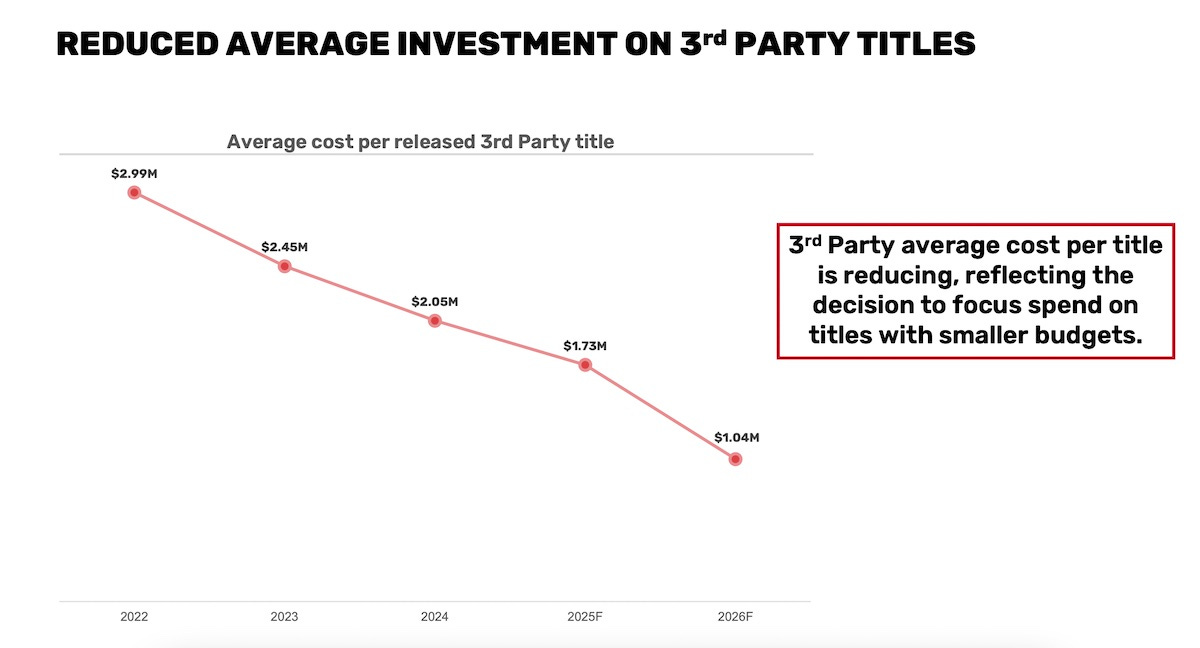

Just two more slides before we’re done! First, here’s a slightly depressing one if, say, you’re a third party dev wanting to get an appreciable amount of money from a Devolver - or likely other indie publishers:

The good news? Publishers are still signing third party games. The bad news? Since many new games are not doing well, and cost of development is not well correlated to cost of success, they’re looking for smaller, more agile projects. (And Devolver would probably prefer to spend bigger money on games they own the IP for, e.g. Astroneer.)

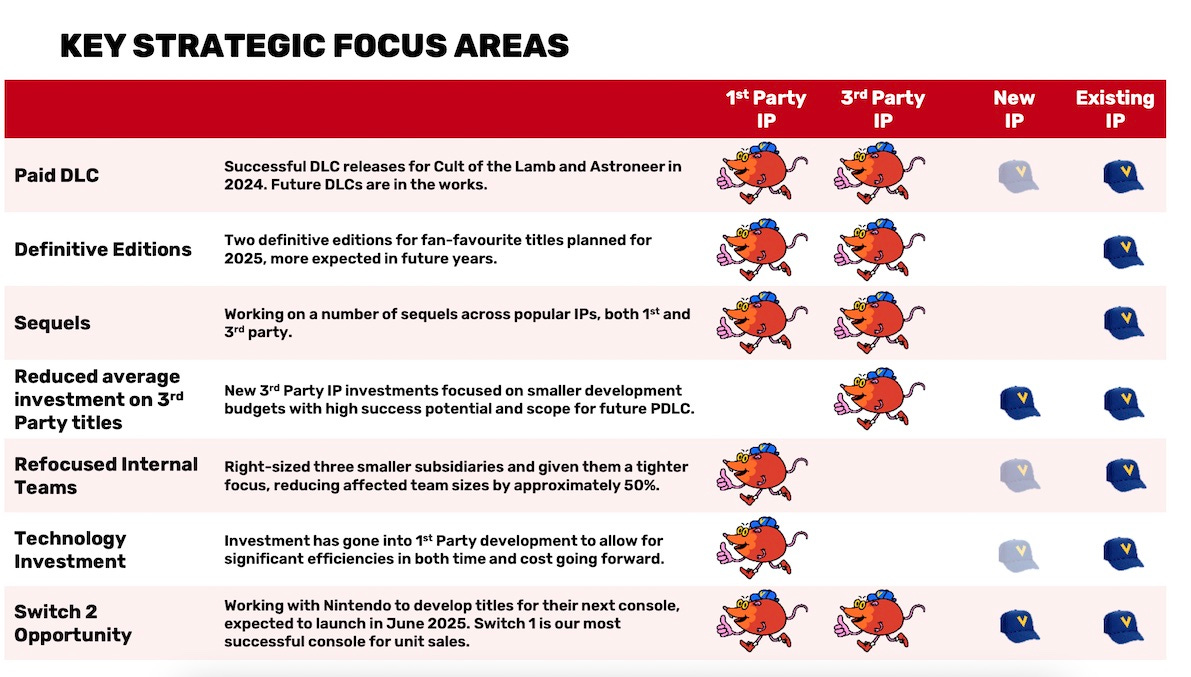

And finally, deeply appreciate that Devolver uses cursed mascot Volvy as a checkbox equivalent in their public financials. This slide from their investor presentation is a good encapsulation of how discovery changes have shifted their focus:

While other publishers have hit the ‘breakout debut’ jackpot in recent years - and there’s a lot of skill involved in doing so - perhaps amassing and optimizing portfolio is the only way to be sure you stay solvent in today’s delightfully chaotic market?

Oh, and a bonus image, from Devolver’s much-longer, and actually quite interesting Annual Report. Yes, we like being mentioned first in this trend too, *strokes beard*: