The biggest discovery change in Switch (& Switch 2!) eShop history

Let's look at it - also, the big Steam winners for this week, and lots more....

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Look, there’s not just a lot going on, there’s a LOT going on. (It’s advanced into a ‘use capslock’ news situation, folks.) Sure, there’s our lead story about Nintendo’s eShop - and our ‘new Steam hits this week’ section for GDCo Plus or Pro subscribers - but also notable news from Apple, Epic, Xbox, Roblox, and 3DO*. (Fine, not 3DO. This week.)

Before we start, who remembers ‘the PlayStation Phone’? We found a blog post about 2011’s Xperia Play from Sony Ericsson, an early Android device which had “a sliding mechanism and familiar button layout [which] gave the device a console-like feel.” Minecraft Pocket Edition started there, but sadly, the phone wasn’t ‘Chicken Jockey’ hot…

[LATE-BREAKING NEWS: yep, Grand Theft Auto VI switching its release date from 2025 to May 26th, 2026 this morning has major game discovery ramifications for late 2025 AAA releases, and perhaps mid-2026 games too. But those ramifications are largely… self-evident!]

News: Oblivion tops Steam debuts for April 2025…

Chunkin’ out the news hits for you, as our brain feels like a middle-schooler who’s been yelling ‘bombardillo crocodillo’ too much, here’s what we’ve got:

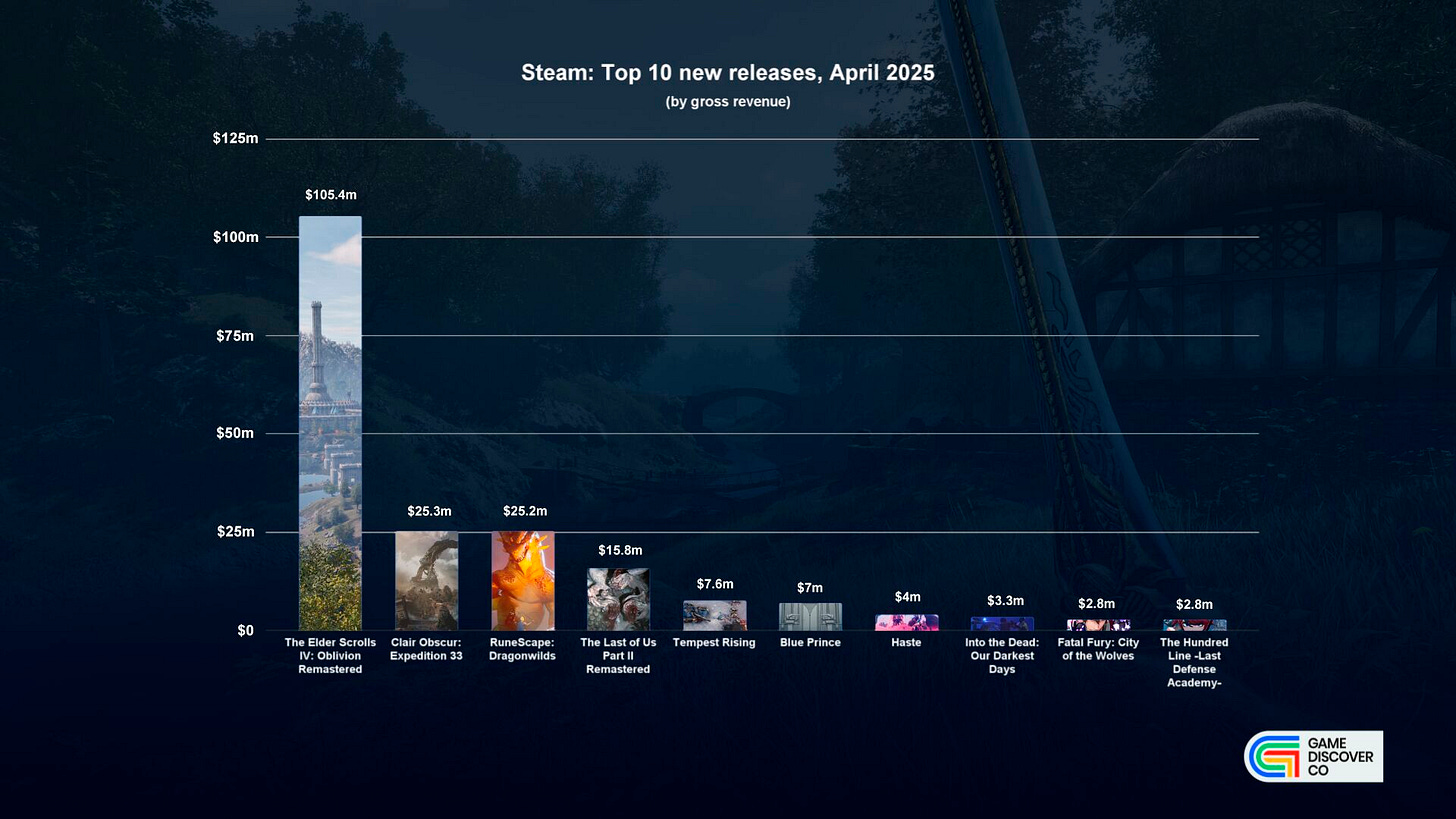

The Top 10 new Steam releases of April 2025, according to GDCo, are headed by that 'stealth drop' of the remastered Oblivion ($105.4m gross), with breakout Western JRPG Clair Obscur: Expedition 33 and successful survival crafter spinoff RuneScape: Dragonwilds neck and neck at #2 and #3, each with ~$25m.

The other breakout new Steam IPs of the month were throwback RTS Tempest Rising ($7.6m), first-person procedural puzzler Blue Prince ($7m), and 'gonna run fast' procedural sprinter Haste ($5m) - congrats to 'em all. And there was a handy performance from The Last Of Us Part II Remastered (#4, $16m).

Xbox has raised the worldwide prices for a bunch of its game hardware - here’s some handy before/after graphs, showing “the Xbox Series X increasing by $100 to $599.99 [in the US], and the base Series S model rising $80 to $429.99.” Also confirmed: “some new Xbox games will increase [MSRP]… to $79.99 from this Holiday season.”

Ichiro at We Love Every Game is doing some cute mini-experiments with Steam data - here’s “a sort-of toy, sort-of brainstorm tool that takes two tags and creates a name for the resultant combo”, and much sillier, here’s a new physics-based way to navigate the Steam store. (Mm, physics.)

The judge in the Apple vs. Epic case got plenty mad at Apple for charging commission on IAP outside of the U.S. App Store, and we dug M.G. Siegler’s take that this is Tim Sweeney’s ‘last laugh’, Joker-style. (The ability to link out to alt, ‘no 30% cut to Apple’ payment methods may supercharge off-platform webstores - and many F2P mobile games have successful ones running already.)

Epic’s been quick to capitalize on the momentum, with Tim Sweeney saying they’ll “return Fortnite to the US iOS App Store next week”, and announcing its own webshops, alongside Epic Games Store offering “0% revenue share on their first $1,000,000 in revenue per app per year” in June - across both PC, mobile & web.

‘Trad’ game journalism is having a bad one, with Vox’s Polygon sold off to content aggregator Valnet & losing most of its staff, and GameSpot’s Giant Bomb sub-brand - owned by the folks at Fandom - running into all kinds of issues. (Original content that isn’t guides-centric is getting increasingly difficult to fund?)

Here’s a tiny/nice Steam improvement: if you’ve got a standalone demo page for your game, as Tinkerlands has, Valve recently added an easy ‘Add To Wishlist’ button in the ‘Check Out The Full Game’ section below the demo download link.

There’s yet more impressive Roblox results for Q1 2025, with “Revenue +29% to $1.04B…. DAUs +26% to 97.8M, Hours Engaged +30% to 21.7B.” They’re expecting ‘only’ 14% - 17% annual revenue growth, and “the Roblox developer community earned over $1 bn in the last twelve months for the first time.” Reminder: cos of weird Robux revenue recognition, look at ‘free cash flow’ (+$426m), not profit (-$216m.)

Some excellent advice (with data) from Louisa Sheringham: “REPOST YOUR TIKTOKS ‼️” By repurposing short-form content for Promise Mascot Agency onto Instagram/Facebook Reels and YouTube Shorts, she “achieved ✨1 million views✨ ..and only around 300k of that came from TikTok 👀.”

Xbox’s actual financials for Jan-Mar 2025 seemed ‘fine’: “Total: $5.72 billion; Content & Services: ~$5.39 billion (+8%); Hardware: ~$329m (-6%)”, with estimates of Xbox hardware sold at a non-stellar ~800k. Boasts? “PC Game Pass revenue increased 45% YoY.. Cloud Gaming record of 150M hours played in a quarter.”

‘Hot take’ of the week? Mikhail Klimentov on why “high-profile failures in the video game industry have changed how we talk about games for the worse.” He laments: “why did business augury become one of the primary ways in which people [even game reviewers, he implies] talk about games online?” Too much vulture-watching, folks..

Microlinks: Meta’s Reality Labs quarterly revenue was down 6% to $412m, "due to lower Meta Quest sales.. partially offset by increased sales of Ray-Ban Meta AI glasses"; PlayStation Plus’ Essential games for May are Ark: Survival Ascended, Balatro and Warhammer 40,000: Boltgun; top ‘trad media’ coverage for the week was for Switch 2, Oblivion, Clair Obscur, and PlayStation’s upcoming Ghost Of Yotei.

The biggest discovery change in Switch history…

When Nintendo rolled out its Ver 20.0.0 operating system update for the OG Switch on April 29th, it appeared to be an ‘early look’ at Switch versions of some of the new features rolling out for Switch 2, such as the ‘Virtual Game Card’ features, which deals with game sharing between systems more elegantly - and a little more restrictively.

But unlisted in the update, and spotted by YouTuber GVG shortly afterwards, was a major change to the most-viewed eShop charts. As we spluttered on LinkedIn:

“Hell has frozen over, folks, and Nintendo has massively changed chart discoverability with the latest Switch eShop OS update - in such a way that makes it clear that it'll also carry through to the Switch 2. Basically:

- BEFORE: all charts and deal page Top 30s were sorted by 'downloads in the last 14 days'

- AFTER: all charts and deal page Top 30s are sorted by 'revenue in the last 3 days'.”

(How do we know this? It says it at the bottom of the chart pages! We appreciate the transparency there, Nintendo…)

We’ve been discussing eShop discoverability issues since 2019 (!), and one example from 2021 has players saying sorting by download count can be an issue: “Nintendo's sh*tty interface specifically draws extra attention to lower-effort games… it's especially apparent in the 'sale' section, and that's because games are ordered by raw quantity of sales.”

Our impression of the Switch eShop improvement process was that, basically, there was no internal process to iterate and improve it. The company just seemed happy about the torrent of third-party games were being released on Switch. (Historically, Nintendo consoles haven’t always had amazing third-party support!)

It’s absolutely hilarious that the first major iteration point for the eShop charts (besides some hackfixes) was ‘we’re making a new console - how can we improve things?’, but… that’s Nintendo for you. And we’re 95% sure this new chart format appears on Switch 2 too, given ‘include Switch 2 games’ tickboxes appeared with this OS update.

So what does this actually mean, and how can you understand the ‘before and after’ state & strategy? We can help you there, since you can change the search options on the Switch eShop to look at the previous ‘download-first’ rankings, and compare.

So here’s the Top 30 rankings for the U.S. eShop on Great Deals and Best Sellers (Google Drive doc) - showing the ‘before’ and ‘after’ games listed. Why is this important? Because unless a player is searching directly for your game, these are the main ‘discovery surfaces’ on the Nintendo Switch and Switch 2.

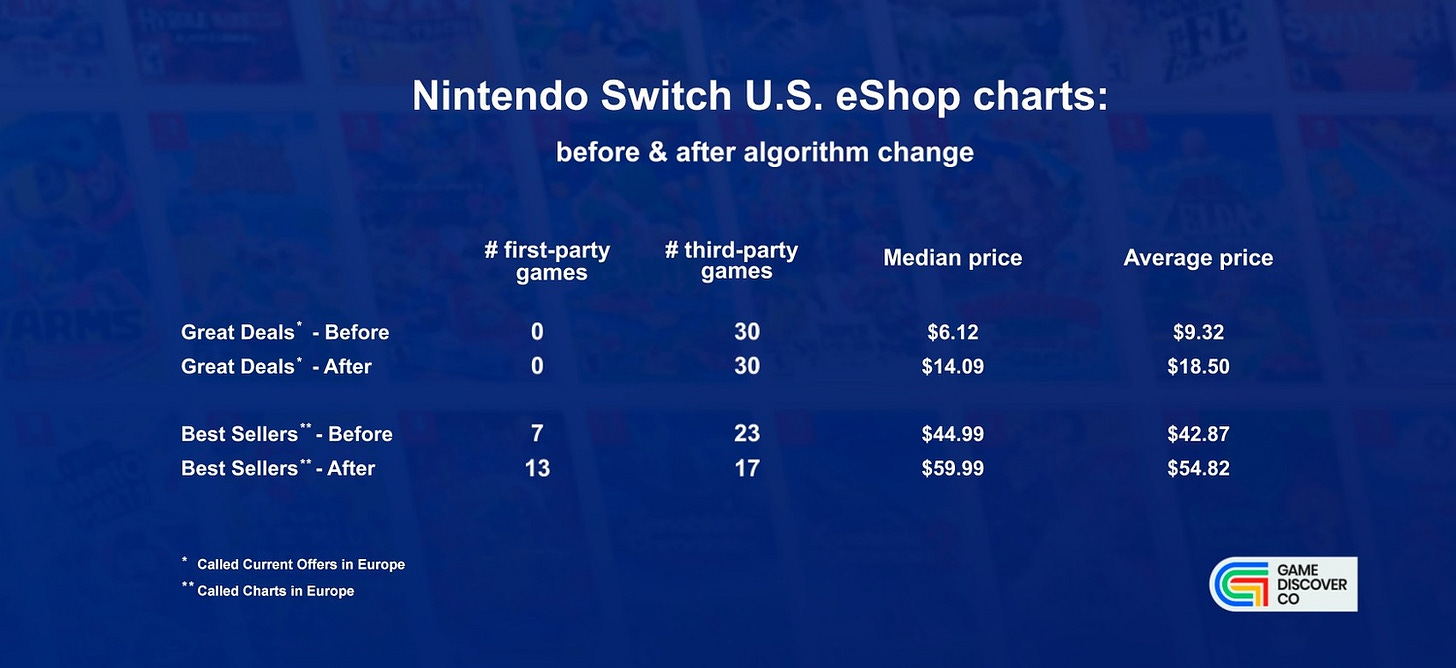

Feel free to browse the link to see the precise featured games. But we also made a handy summary for you (below - and yes, these charts are called Current Offers and Charts in Europe’s English language interface for ‘mysterious regional’ reasons):

So, some conclusions and comments on possible strategy changes, based on this shift:

Extreme discounting is no longer the ‘silver bullet’ it was: the median price of a Top 30 ‘Great Deals’ title is up from $6.12 to $14.09 . And the average went from $9.32 to $18.50. Titles like Hole.io - 60% off and #3 in Great Deals before, nowhere to be seen after - are having their discovery obliterated by the change.

It now pays to be an expensive game which is discounted, not a cheap one: for example, a ‘50% off’ Ninja Gaiden: Master Collection - discounted from $39.99 to $19.99 - jumped from #18 to #6. And Mortal Kombat I - 67% off, at $13.19 - from #23 to #7.

First-party Nintendo games got a major boost on the Best Sellers chart: because they charge $60 (or more!), overall best sellers had 7 of the Top 30 games be published by Nintendo before, but 13 of the Top 30 after. (Some of the new games sneaking in: New Super Mario Bros U. Deluxe, Pokemon Scarlet & Violet.)

Non-major publisher thoughts on this change? James Barnard of Let’s Build A Zoo/Dungeon fame had a good take in comments on my LinkedIn post: “A $20 game has to do three times as well to compete with a $60 title in terms of revenue. (I did see our game in the sales chart - so maybe it’s not the end of the world.)”

We would concur - it’s not the end of the world, and discounted, cheaper games can still get in the charts if sufficiently popular. And in a lot of ways, this is Nintendo resetting its discovery algorithm to the ‘normal’ way of doing things. Steam’s real-time top charts are calculated by total revenue, for example.

To add: the ability of people to ‘game’ the previous Switch eShop algorithm with discounts led to high visibility for inexpensive, sometimes lower-quality games. And we think players repeatedly buying them and being disappointed might have led to some disenchantment. Why would a platform ‘recommend’ a game that isn’t good?

So that’s been fixed! But Steam also has its ‘New & Trending’ visibility and various wishlist charts, which allow front-page visibility for smaller games in ways that incrementally help games, and make everyone feel like the store is trying to be ‘fair’.

And that’s the next step for Nintendo to tackle across the Nintendo Switch & Switch 2. We do think this is a ‘good’ discovery change. But some piquant questions to end:

Will Nintendo add any ‘this game is new & has traction’ charts? A third, ‘New & Trending’ chart is a) easy and b) helps fix displaced smaller games.

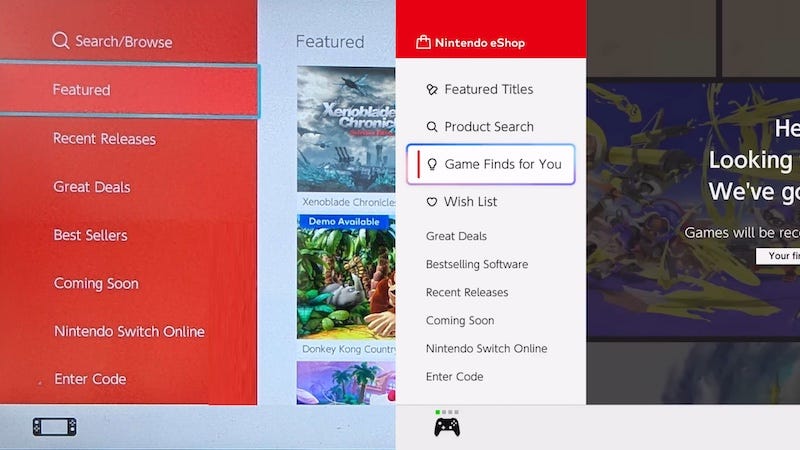

Will Nintendo’s ‘Featured Titles’ section ever become more dynamic? Steam’s is almost entirely algorithmic. And for better or worse, Switch’s tends to be heavily curated, not often-rotated, and tricky to get on.

Will the Discovery Queue-like ‘Game Finds For You’ on Switch 2 be wide-ranging? By this, we mean - will it recommend just $60 JRPGs if you’ve played a JRPG, or will it go deep into catalog?

Whatever the answer, I do think that the new reality for many small/medium games is that it will be more difficult to get into the Switch eShop charts (since your game probably doesn’t cost $60, or is $15 when discounted.) We won’t sugarcoat this - it’s real. But good luck trying…