October 2025's top new Steam (& console) games revealed...

Also: plenty of discovery news, for your ZIP code and beyond...

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

New week, and new opportunities to poke at numbers? We’ll take it, thanks to October 2025’s new Steam and console releases, dominated by EA’s Battlefield 6, but including all kinds of other interesting games. We have at it below…

Before we start, one last spooky post-Halloween link? Here’s a great piece on the origins of the monstrous characters in Capcom’s classic fighting game Darkstalkers, from Irish-named succubus Morrigan to merman Rikuo, “a tip of the hat to Ricou Browning… who played the titular monster in 1954’s Creature from the Black Lagoon,”

Game discovery news: a Resident Evil requiem..

Here we go, with a large selection of game platform & discovery newslets to release into the pond of your mind:

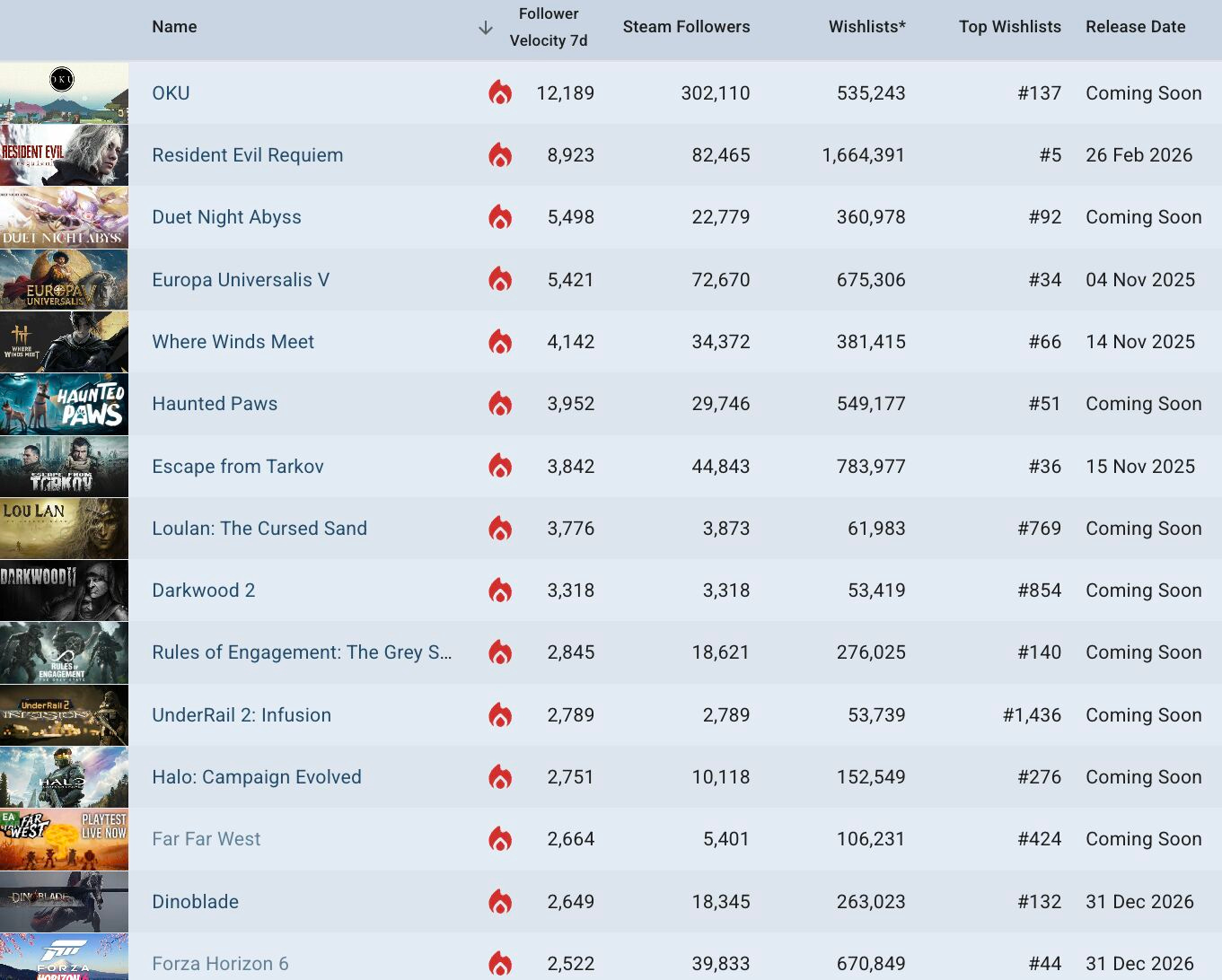

Checking GDCo’s ‘7-day trending’ unreleased Steam game follower chart (Oct 28th to Nov 3rd), Resident Evil Requiem (#2) got a big boost, since pre-orders opened for Capcom’s horror sequel. And Duet Night Abyss (#3) is a F2P mobile/PC gacha ARPG which just launched PC client-only, but skipped a Steam release for now.

Some of the Top 10 are soon-upcoming releases, inc. 4X standout Europa Universalis V (#4), Wuxia ARPG Where Winds Meet (#5), and the ‘long available off-Steam’ extraction shooter Escape From Tarkov (#7). And a new playtest vaulted ‘co-op spooky pet adventure’ Haunted Paws (aw!) to #6.

New entries? There’s three, actually, comprising Loulan: The Cursed Sand (#8, another historical Chinese ARPG), Darkwood 2 (#9, creepy horror sequel from Pathologic creators Ice-Pick Lodge), and UnderRail 2: Infusion (#11, turn-based dystopian isometric RPG).

Nintendo’s results are out, “with 10.36 million Switch 2 consoles sold-in by the end of September… more than the original Switch (4.7m), PlayStation 4 (7.5m), or PlayStation 5 (7.8m) managed during their first two quarters on sale.” It raised its (conservative!) biz year estimates for Switch 2 to 19m from 15m, and its profit up 15% TO ~$2.4b.

And it’s Mario Kart World which is - unsurprisingly - the lead game for Switch 2, as it “sold in another 4 million units, taking its total to 9.57 million”, a 92% attach rate to Switch 2. (But 8.1m of those are hardware bundles!) Donkey Kong Bananza, a more fair Switch 2 first-party comp, sold in 3.5m units, a ~35% attach rate.

There’s an excellent Vorhaus Advisors survey on U.S. games/tech users reprinted via GameDevReports: “Among 18–34-year-olds, 95% play games. Among 35–54, it’s 87%. 64% of those 55+ play games…. PC saw an 8% YoY increase in people who play >once per week [to 37%] and is more engaged than on consoles.” And lots more detail.

ICYMI: Microsoft CEO Satya Nadella said he views its competition in gaming not as other game platforms, but TikTok: “The game business model has to be where we have to invent maybe some new interactive media as well, because after all, gaming’s competition is not other gaming. Gaming’s competition is short-form video.”

A study in contrasts for platform marketing? PlayStation’s lifestyle marketing for the holidays is the high-concept ‘It Happens On PS5’, all abstract, high-budget coolness. Alternately, Xbox’s latest Game Pass ad calls back to the ‘90s by having the protagonist hide in a video store return box for classic Xbox games. YMMV!

We’re not (just!) a Doug Shapiro fan newsletter, but his latest on ‘Big Media’s disadvantage’ is worth reading: “High production values, big budgets, and well-known professional talent used to be the key markers of quality. Today… [consumers’] definition of quality now includes… authenticity, relatability, snackability, and social currency.”

Meta’s latest Q3 financials for VR/AR? Revenue of $470m, up 70% YoY, and a loss of $4.4b (!), as “retailers are stocking Quest headsets for the holiday season.” But expect Q4 to be slower, due to Quest 3S release timing from 2024. Oh, and HorizonOS is part of its own standalone division now, indicating its importance.

Boiling Steam has been monitoring Linux compatibility (via ProtonDB) for Windows games over time, and says general compatibility at an all-time high, helped by the high-profile Steam Deck/SteamOS usage of Linux. In addition, “the amount of games that refuse to launch” is at 10%, an all-time low. Pretty good!

Massive Entertainment founder Martin Walfisz has some pyramid theories: “The High Pyramid defined the early decades of gaming. Complex tools and specialized knowledge meant that only a few could make games… The Wide Pyramid is emerging as tools become easier and more powerful. Game Bands - small, highly creative teams of up to 10 people - will become the cultural equivalent of rock bands in music.”

Microlinks: PlayStation seems to be planning cloud streaming directly to PlayStation Portal and PS5; Newzoo has interesting data on age distribution of Roblox players vs. the general population of gamers; coming to Xbox Game Pass is Call of Duty: Black Ops 7, Winter Burrow, Dead Static Drive & more.

Oct. 2025’s top new Steam (& console) games…

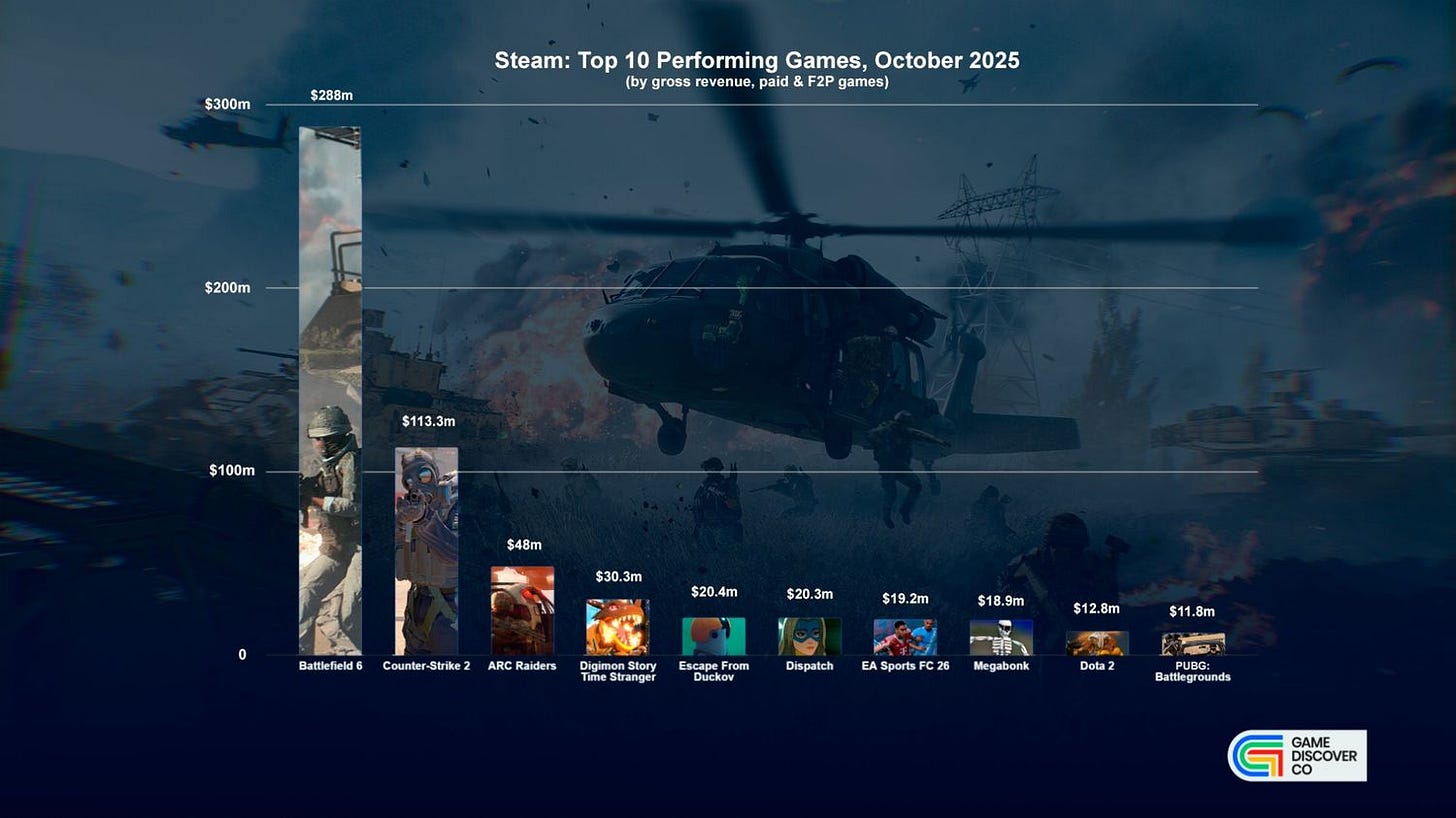

Yep, we’re doing this every month now - here’s September’s, for example - so let’s take a macro-look at GameDiscoverCo’s estimates of the top PC and console game sellers of Oct. 2025. And once again, it’s a busy month for new hit releases (above)! Analyzing:

The chart’s a melange of new IP and established sequels, again: we count four titles that are in some way existing IP/sequels, including Battlefield, and Digimon, Little Nightmares, and PowerWash Sim follow-ups further down the Top 10. (And then six new IP, although all are in strong, thematic subgenre areas.)

Battlefield 6 was as big a hit as we thought it would be: this number includes pre-sale numbers before Oct. of at least 2.5m. But 7 million Steam units sold of EA’s first-person shooter comeback, by the end of October? What execution!

Escape From Duckov & RV There Yet? are the viral indie hits: the China-first goofy top-down extraction shooter Duckov scaled to 1.7m units in Oct, maxing out at 300k CCU late in the month. And RV There Yet?, an internal game jam title with a cheap price ($8) & viral theme, also hit 1.7m. (Bonus viral indie: brick-breaker roguelite Ball x Pit, which managed nearly 600k.)

We also see at least one semi-surprise hit in here, ‘superhero workplace comedy’ narrative management game Dispatch, which we expected to be big, but not ‘830k Steam units in its first week’ big. (It’s since confirmed one million sold, cross-platform, and we’re hoping to cover it in more detail soon.)

Moving on to top releases by revenue, #2 (behind Battlefield 6 at $425m, of course) is new extraction shooter ARC Raiders. Even with an Oct. 30th release date, it’s grossed $55m - and is rapidly scaling from there - and hit 1.5m sold. From Friday’s newsletter:

“The dev team (who are ex-DICE and also created The Finals) are clearly a cut above, and the 91% positive English reviews center on the fact you can actually have sane social interactions with other ‘random’ players, something that’s insanely difficult to model for…. looks like the switch from F2P (The Finals) to paid (ARC Raiders) has really worked out.”

Punching above its weight $-wise is creature collector RPG Digimon Story Time Stranger (#3, $38m), thanks to $70-$120 pricing and relatively high-price regional mix. (The game hit 85k CCU, too, showing a lot of love for the long-standing franchise.)

Overall, nine games in total grossed >$10m, including party-based co-op dungeon adventure Fellowship ($10.7m) and the latest Little Nightmares (horror co-op) & Jurassic World Evolution (dino park management!) titles.

Looking briefly at ‘copies sold across all paid games’ on Steam in October, you’ll see a bunch of new games that we already talked about, but also some interesting new titles. These can be roughly subdivided into:

Viral in previous months, still going viral: 3D roguelike Megabonk, which launched on Sept. 18th, piled on another 2.2m units to hit >3m in total. And ‘roguelite slot machine nightmare’ CloverPit, which debuted at the end of Sept, added ~850k players during Oct, and is now at ~1.2m on Steam.

Big hits from way back that did some serious discounts: that would be games like oddly underdiscussed survival horror sequel Sons Of The Forest - 14m copies sold, added nearly 1m in Oct. via 2x discounts from $30 to <$10. And also wizard sim Hogwarts Legacy, which has 11.5m sold, and added ~900k due to a highest-ever discount from $60 to $9 (!).

Finally, the overall top-grossing games on Steam in October 2025 - across both paid and F2P - has Valve stalwart Counter-Strike 2 at #2. (Always in the Top 2!) There’s depressed figures for some other F2P games. (Maybe Battlefield 6 got in the way?)

Now let’s finish up by looking through the console platforms. To start, here’s GDCo estimates for new paid games in September 2025 on PlayStation:

There’s no surprise here that Battlefield 6 is #1 with a bullet - we have it at 4.6m units sold in Oct. (and over 12m units across Steam, PS, and Xbox.) But Sucker Punch & PlayStation’s console-first samurai adventure sequel Ghost Of Yotei is faring great too at #2, with 2.7m units. (13% of those are in China and 5% in Japan, with 34% in the U.S.)

We’re also seeing ARC Raiders scale on PS5, with ~500k units and quickly rising. Otherwise, Little Nightmares III (350k) and Digimon Story (230k) both add to their Steam totals on PlayStation, with the former having a particularly good console sales ratio. (Dispatch, at <100k PlayStation by EOM, is more Steam-first, interestingly.)

As for PlayStation Plus Essential additions in Oct: the hilarious Goat Simulator 3 saw a 1.9m players increase to hit 2.7m PlayStation players; Alan Wake II saw an extra 1.2m to hit 2.5m; cult hit Cocoon added >300k players and hit 350k in total.

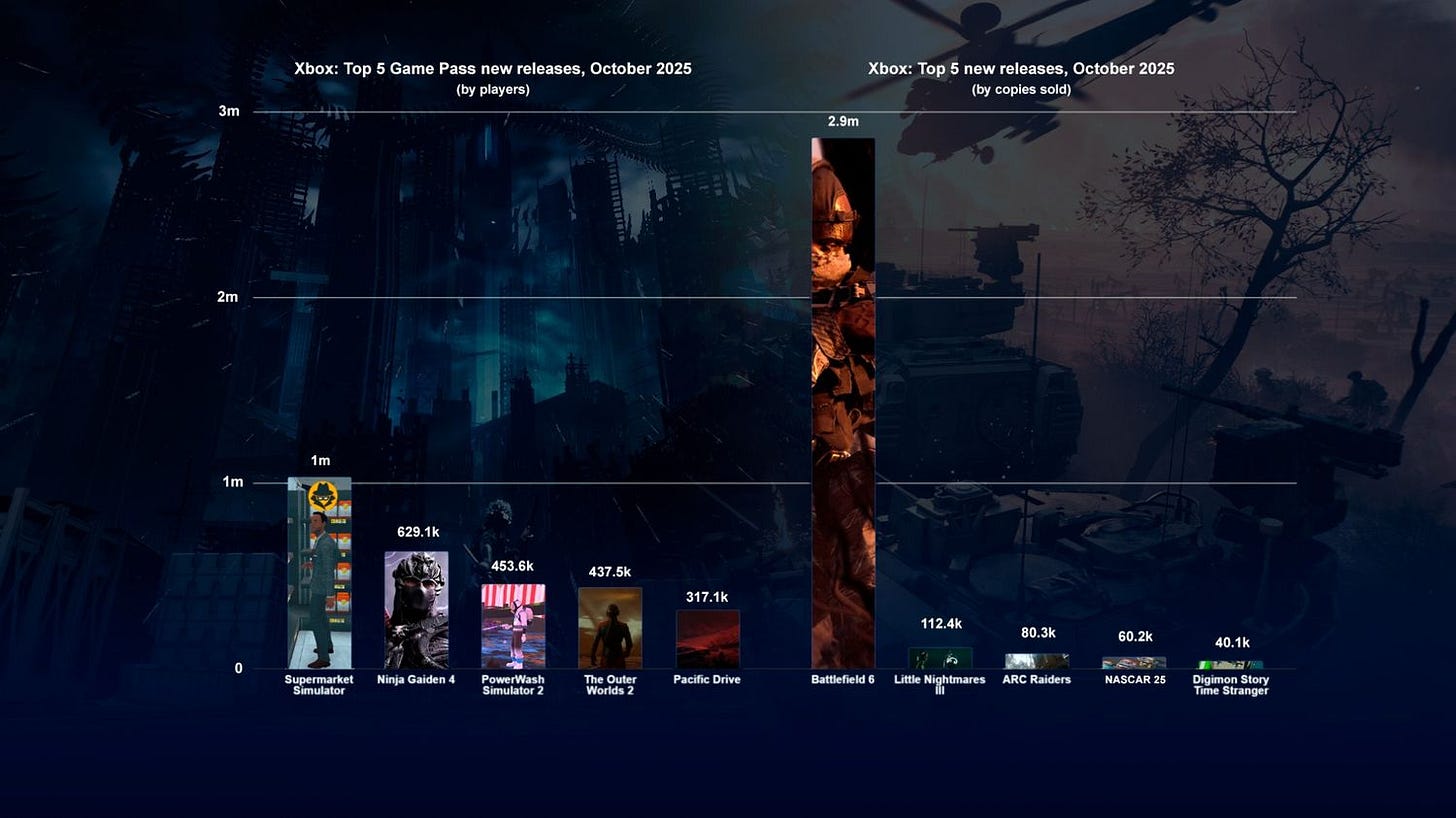

Our final graph takes a look at Xbox new releases, both Game Pass (left) and overall sales (right). Normally, the left chart would peak higher than the right, but thanks to Battlefield 6 (2.9m sold on Xbox in Oct), it’s the opposite way around this month.

The other top-sellers on Xbox are at much lower ratios than BF6, which might have sold >50% of its PlayStation units on Xbox, thanks to core U.S./UK Xbox console users being rather Battlefield-pilled. (The ratio is <=30% for many other titles.)

As for Game Pass, would you be surprised to know that lots of people want to play Supermarket Simulator on GP? The entertaining first-person sim had >1m GP players during October, followed by Ninja Gaiden 4 (~650k in GP, alongside ~90k paid on Steam & ~110k on PlayStation, btw - it’s doing fine, if not giant.)

Also doing well on Game Pass in Oct: PowerWash Sim 2 (450k), The Outer Worlds 2 (a late-month 440k, but we now have it at ~1m), and Pacific Drive (320k). And the first-party adventure Keeper just missed the Top 5, with ~200k players.

Finally, finally (finally!) - the Switch 1/2 eShop had some decent new game performers in October. Our data, which excludes physical Switch sales and is based around extrapolating from the U.S. and U.K. eShops, says:

First and second party titles were big on eShop, as per usual: Pokemon Z-A reached >1.1m eShop players, and the Super Mario Galaxy + Super Mario Galaxy 2 remaster crested a combined 500k units.

Third-party eShop games are doing fine, but not stellar: by our estimates, Ball x Pit (124k), Plants vs. Zombies: Replanted (77k), Little Nightmares III (55k) and Absolum (38k) were the top new third-party games for the month.

On trends: there’s definitely a feeling that a lot of veteran Switch players with large existing eShop libraries are picking up Switch 2, and are mainly interested in new Nintendo games. (And perhaps big Switch 2-exclusive conversions with physical carts like Cyberpunk 2097?) But we’ll see if that shifts over time… toodles.

[We’re GameDiscoverCo, an analysis firm based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide real-time data services for publishers, funds, and other smart game industry folks.]