Doom: The Dark Ages, The Precinct score on Steam

Also: lots of game discovery news, and an update on our GDCo Pro service.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome to a truncated Friday newsletter, folks. Why slightly smaller? It’s GDCo’s annual company offsite this week, and we’re tooling around Berlin together. But we’re taking time out from the Ampelmann store to bring you discovery news galore...

Oh, final reminder: our 10-day GameDiscoverCo x Oakland Ballers ‘Scrappy Game Jam’ just kicked off. You too could win a GDCo Plus lifetime membership & cash by making a tiny possum game. (Dad joke: second prize is two Plus memberships?)

Game discovery news: Switch 2, GTA 6 chatter…

OK, time to poke at the latter half of this week, which has been relatively full of concrete discovery & platform news:

The latest ‘trad media coverage’ charts from Footprints.gg (above) show that Switch 2’s imminent release and GTA 6’s delay are still dominating. They’re followed by the new Doom, the still-buzzing Clair Obscur, and unembargoed preview coverage of Kojima’s PS5-first Death Stranding 2, which is getting v.good buzz.

PlayStation’s latest results show that in the three months ending March 31, 2025, Sony sold 2.8 million PlayStation 5s, hitting 18.5m for the fiscal year (down from 20.8m in the last FY.) There’s now ~78m PS5s out there, “just over one million units behind where PlayStation 4 was at the same period of its lifecycle.”

One issue for the rest of 2025 for PS5, besides the Grand Theft Auto VI delay? “Sony told investors that it is considering to ‘pass on’ the cost of the U.S. tariffs imposed by the Trump administration to hardware prices.” Those tariffs aren’t 140% any more, but even ‘paused’ at 30%, they’re still considerable - we’ll see what happens.

Overall, Sony’s results for the PlayStation biz were promising: “PlayStation full-year operating income jumps 43% to $2.8bn… Sony sold 303.3 million games during the fiscal year, an increase of 6%.” Also: PSN monthly actives went from 118m to 124m YoY - possibly buoyed by PC players. But exchange rate headwinds are here…

Epic’s attempts to get Fortnite back on iOS are still ongoing - they’ve “resubmitted Fortnite to… App Review in the US after… no reply to a previously submitted version.” [UPDATE: OK, it’s official: “Apple has blocked our Fortnite submission so we cannot release to the US App Store or to the Epic Games Store for iOS in the European Union.”]

What Steam wishlist effects can you get from a B2C game event appearance as a smaller indie? The devs of Cat Secretary posted a good example, revealing “we received over 1,600 wishlists” from a PAX East appearance, and noting an anti-AI message seemed to resonate.

Digital Foundry is analyzing the official release of Switch 2’s final hardware specs: “When the original Switch first launch[ed], Nintendo described it as a ‘custom Nvidia Tegra processor’, when in reality it was effectively a vanilla Tegra X1. However, Switch 2's SoC… is very much custom silicon designed specifically for Nintendo.”

A widely reported third-party Steam data leak was tangentially related to Steam - it’s two-factor authentication SMS messages - but as Valve explains: “The leaked data did not associate the phone numbers with a Steam account, password information, payment information or other personal data.”

Helldivers 2 dev Arrowhead confirmed its next game will be self-published, not Sony-published, and you’ve gotta presume that the 2024 mis-step over enforced PSN logins on the Steam version contributed*. (*Though CEO Shams Jorjani also says “Playstation are great”, and maybe they just have the $ to go it alone now.)

The transcript of Nintendo’s earnings call Q&A is up in English, with a few interesting tidbits: “First year guidance of 15M units for Switch 2, below many forecasts… is due to ‘relatively high’ price compared to OG Switch, as opposed to supply limits… Tariff situation did not have an impact.”

Discord’s 10-year anniversary blog post has some rare stats on the key discovery platform, with >90% of its 200 million MAU (!) playing at least one game monthly. Also, on friend hangs & co-op: “92% of you are playing games while hanging out in voice… When playing with a friend, your gameplay session is 7 times longer.”

A lawsuit against Meta from Kelly Stonelake spawned a NWN interview with the former Horizon Worlds-related employee, and trickiness around unauthorized kids in virtual worlds is definitely a theme: “I was explicitly told not to take notes on anything related to children in Horizon Worlds.”

Microlinks: Microsoft is laying off 6,000 people, ~3% of its staff, including some in Xbox; Kickstarter has finally added a ‘pledge manager’ feature to help with rewards fulfilment; PlayStation Plus Game Catalog for May includes Sand Land, Soul Hackers 2, Five Nights at Freddy’s: Help Wanted, and Battlefield V.

GameDiscoverCo Pro: time to be a bit less bashful!

We’ve been doing a traditional SWOT analysis with the GameDiscoverCo team here in Berlin, and have an ‘opportunity’ to… be less shy about our product? You know GDCo for this newsletter, but may not realize that much key data presented here is sourced from our GameDiscoverCo Pro SaaS PC/console data subscription.

The stats speak for themselves:

we now have >60 game companies licensing the Pro data, which is a massively enhanced version of our indie-centric GDCo Plus data/newsletter sub.

our data set includes all Steam, PlayStation, Xbox & even Switch eShop game data*, inc. current & historical players, country splits, revenue, DAU, MAU & more. (*We’re also planning Switch 2 eShop player estimates for shortly after release.)

the data, available via the Pro website (above) & a comprehensive GraphQL-powered API, has accurate estimates, sure. But it goes beyond that.

It’s super useful to know how many copies a game has sold, but the real takeaway here is in comparison and insight. That’s why we do things like track Manor Lords’ highest ‘affinity’ titles: games enjoyed by Manor Lord players much more often than the ‘average Steam player’:

Other use cases that our GDCo Pro subscribers find particularly helpful are:

Tracking country splits and hours played for games in easily comparable ways. (How long should your ARPG be? How many Japanese players should you expect?)

Comparing algorithmic wishlist estimates, Hype Score, and pre-release growth velocity for all 31,000+ unreleased Steam games, tag & date sortable.

Looking at console game sales and revenue numbers with Game Pass and PS+ download splits built in. (8m downloads doesn’t mean 8m copies sold!)

Easy comp forecasting for games just by adding comparison games to our interactive forecaster page. Say goodbye to lots of manual Excel work.

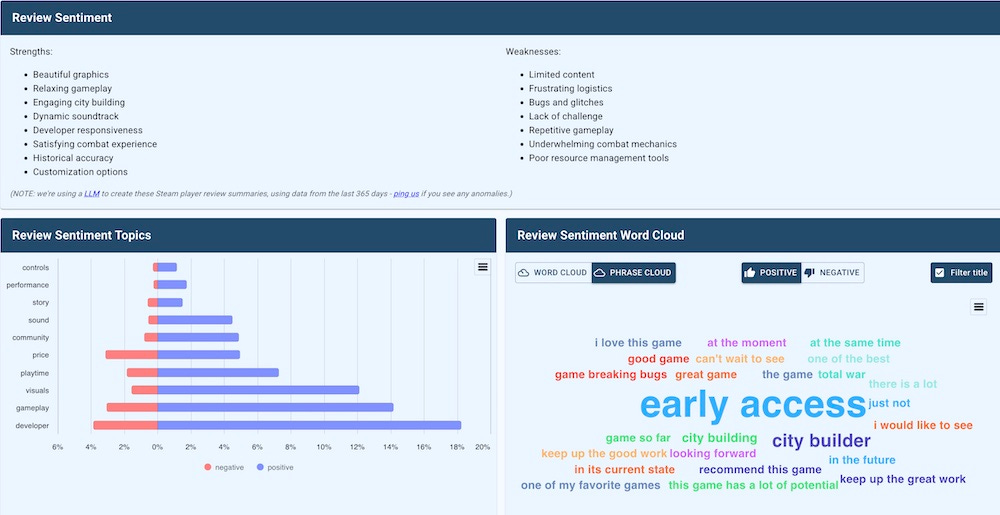

Our plans for GDCo Pro include going deeper into the data - Steam recommendation systems, analysis of wishlist quality metrics, and more. We’ll deconstruct these like our existing Steam review analysis (below, for Manor Lords) & we can’t wait:

Anyway, finishing up on the SWOT analysis - your ‘opportunity’ is to hit us up for a GDCo Pro demo log-in & chat. The only threat (the ‘T’ in SWOT)? Not using enough data to understand market trends. Yes, numbers aren’t the be-all and end-all - but it sure is useful to contextualize and plan with it…