BattleBit Remastered: how did it sell millions?

Also: the end of the 'growth stock bubble' trilogy & lots of discovery news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

It’s the middle of the week, things are going on - and continue to go on - in the world of game platforms and discovery. And we are here to report on these, as you say in the popular vernacular, ‘goings-on’.

This time out, we’re rewinding the clock slightly - with the benefit of new contextual data - to the ‘Summer of BattleBit’, and asking ourselves how all those kooky gamers with flowers in their hair got wayy into a Roblox-lookin’ 250-player FPS, maaan.

[HEADS UP: our upgraded Plus PC game data suite is here - you can subscribe to Plus now to get full access to it, weekly PC/console sales research, an exclusive Discord, six (!) detailed game discovery eBooks - & lots more. Check out this newsletter for details on new features.]

BattleBit Remastered: data-ing up the smash hit..

Now, we’re aware we’re a little late to the party with any analysis of BattleBit Remastered, the small-dev, “low-poly, massive multiplayer FPS” which supports 254 players per server (!), and released back in June on Steam.

BattleBit has continued to sell spectacularly. Current GameDiscoverCo estimates have the game at 3.66 million copies sold on Steam, with a $49.3 million gross and $28.6 million net. (It’s only $15 USD, with regional variations and no IAP. So a net of $7.80 per copy after regional price variations, VAT, refunds & Steam cut makes sense.)

As we probe its success, let’s start by diving into some data to understand the game’s context. GameDiscoverCo has ‘Affinity’ data we share with our consulting clients, which looks here at ‘games played by BattleBit players much more than the Steam median’. Here’s Steam tags for the Top 50 highest ‘Affinity’ multiplier comps to BattleBit:

So there’s some clear trends here - first-person, multiplayer, tactical, shooter, war, team-based. And we also looked at the Top 10 highest ‘Affinity’ comps only for ‘larger’ games on Steam - those that are owned by >1 million unique players. Spot the vibe:

So what this tells us, if nothing else, is that there’s a lot of people jumping across from other (mainly, but not only PvP multiplayer) action games. However, GameDiscoverCo just sees game overlap right now - it doesn’t go deeper into ‘personas’ of players.

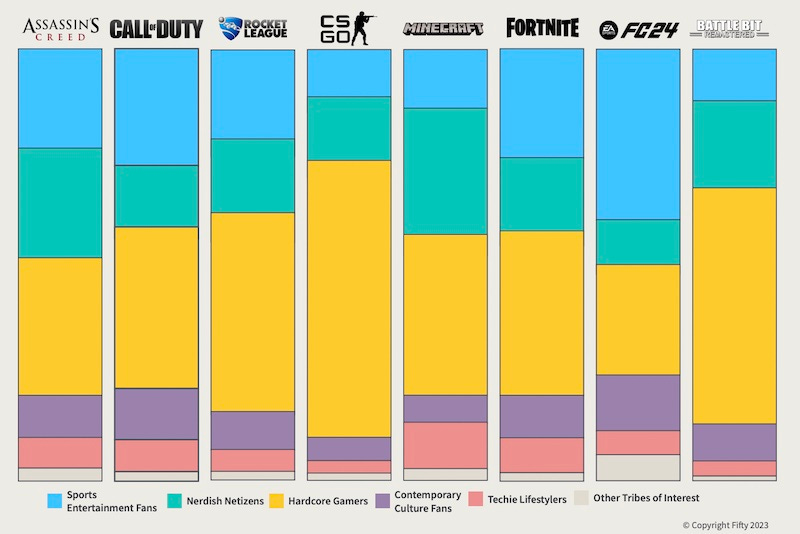

And this is where the folks at audience insights firm Fifty, whose clients have included Supercell, Bethesda, Bandai Namco & Bungie, come in. They put together a neat custom report on BattleBit [.PDF link], which looks at the ‘tribes’ drawn to BattleBit (right) vs. other major game franchises:

This data-led approach of using public social media & other data to try to profile different types of consumer is a really interesting one. And, while it can be difficult to define differences between groups, it tracks that ‘Hardcore Gamers’ are drawn to CS:GO and BattleBit more than to, say, Minecraft or EA Sports FC 24.

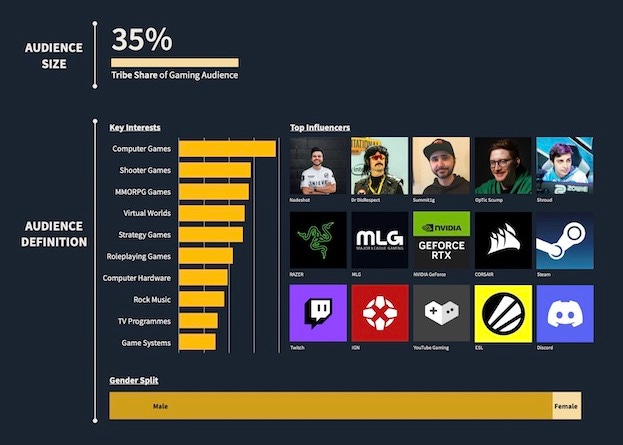

And since Fifty has ‘tribes’ devised for the whole media-consuming Internet, not just for games, you get some interesting results. Here’s the overview of ‘Hardcore Gamers’:

Anyhow, there’s loads more on this approach in Fifty’s full audience report [.PDF], if you want to check it out. But I think they (and we!) have defined the audience using data now. How about we switch to some good-old subjective opinions?

Let’s start with the YouTube video linked above, which kicks off with Habie147 narrating re: BattleBit, passionately: “I feel so vindicated by this game. I have been hate-buying both Battlefield & Call Of Duty for 10 years at this point. And I am now realizing how completely valid that dissatisfaction was in every single way.”

Many discovery successes come from unfulfilled needs, especially when the AAA game biz has moved beyond certain games. For example, my buddies at Ragesquid & No More Robots have had success with mountain biking game Descenders, part of the ‘extreme sports’ genre that was once big for AAA pubs, but largely got phased out.

At its heart, I think BattleBit is an intentionally stripped-down homage to the ‘OG’ Battlefield-style games. And given how big-budget &complex the AAA ‘war games’ have gotten, it makes sense that a cheaper, knock-about title without any IAP or complex monetization - but with infinite charm & lots of features - would do great.

To end, we thought we’d find out why the game’s actual devs thought the game was a smash! So we reached out to BattleBit co-creator Max Fink*, and asked why he thought the game is a big hit. (*Thanks for the intro, Rob Stevenson!)

Max was pretty modest, actually, suggesting it was a hit “because we had a working game at the right time in the right place”, and players “felt the passion we poured into it and so recommended it to their friends.” All true - and remember, this game was announced in its original form back in 2016, so it’s been in progress for a long time.

However, Max also noted some of the key reasons the game took off like it did: “[BattleBit] is easy to pick up and has barely any hardware requirements. In addition to that, the VOIP and game mechanics made it playable for everyone, even if you are really bad at FPS games.”

He’s right, folks - low-skill and ‘potato PC’ players feel welcome, everyone has a good time, and BattleBit is a hit - we think - because it’s feel-good counterprogramming, and also a damn good game. Not exactly easy to replicate (either technically or zeitgeist-wise!), but now we have some more discovery success context, huh?

The ‘growth stock bubble’ - the end of the trilogy!

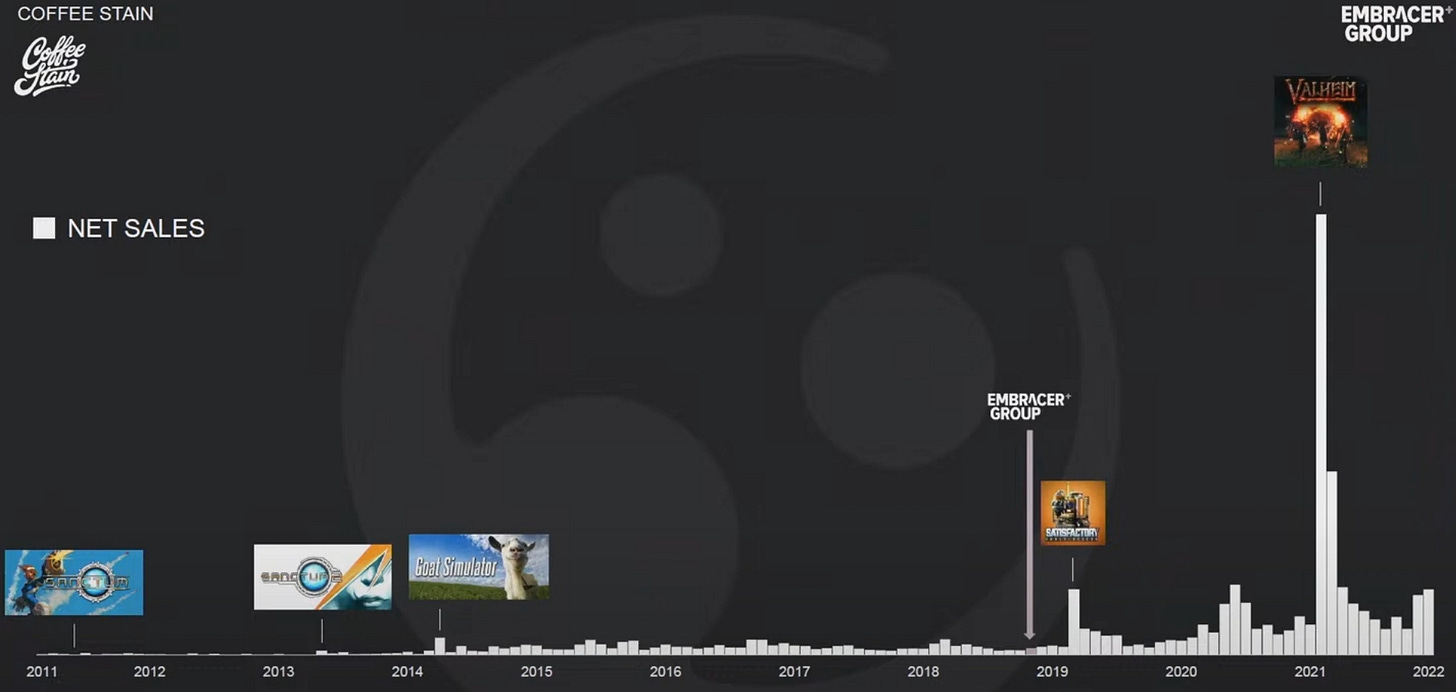

After we spotted Game World Observer’s write-up of the most recent Embracer financial results, which highlighted great growth for brands like Coffee Stain*, but overall pressure to swiftly reduce debt and cut costs, we figured it was time to finish the ‘growth stock bubble’ trilogy.

(*Those precise Coffee Stain numbers are worth reprinting. According to GWO: “Satisfactory - 5 million copies sold, SEK 700 million ($62.8 million) in revenue; Deep Rock Galactic - 7 million copies sold, SEK 800 million ($71.8 million) in revenue; Valheim - 12 million copies sold, SEK 1.7 billion ($152.6 million) in revenue.”)

For those too young to remember us at the time (aw!), the first two parts of the trilogy rolled out like this:

Back in December 2020, we decided to do a longform story called ‘Game company acquisitions & the 'growth stock bubble', commenting: “The pace of game [biz] acquisitions is reaching a fevered pace in certain areas that sometimes makes onlookers say ‘???’” Companies namechecked: EG7, Stillfront, Embracer, and more.

Then, in June 2022, we reported on what happened next, noting: “What we’ve been seeing in these regional markets [like Sweden, Poland, UK] has been a significant decrease in the share price of most of these companies in recent months.” A lot of firms were already way off their over-exuberant stock highs. But not so much Embracer.

What we said then: “The point we made in December 2020 around this model was this: ‘I can’t see a hole in this model until the stock market no longer (over?) values growth stocks, or if one of the companies gets overaggressive and loses investor confidence somehow.’

And oddly, while its competitors fell by the wayside, I think Embracer has retained investor confidence by being the ‘right’ kind of overaggressive. Sharks have to swim constantly or they die, right? That’s Embracer and buying stuff, apparently…

Sure, I still question whether the big hits (Valheim, Evil Dead: The Game) can make up the overhead of the sheer amount of other ‘premium first’ titles in the Embracer portfolio.”

What has happened since? The end of the bubble finally caught up with Embracer too. The ensuing layoffs and dev closings have been well documented. Its stock price had nudged down to just over half its peak by June 2022, but is now about 16% of its all-time high.

Meanwhile, big firms like Electronic Arts - who are profitable and who concentrate on a much smaller amount of ‘cash cow’ games - have seen their share price fairly flat throughout the pandemic and beyond. ‘Boring’ companies make for stable stocks.

In as much as there’s a lesson here, it’s this. Firstly, the stock market sometimes runs on ‘vibes’, especially when things are hot. So a niche exchange was rewarding Embracer’s stock for rolling up a lot of separate game companies and not pushing any meaningful synergies - why battle the market? (Reader: they didn’t.)

Secondly, the ‘distributed’ nature and independence of Embracer led to co-ordination inability. When everybody is left to run their own biz, but some divisions don’t execute or delay their games, there’s no real way you can tell others to ‘make up the slack’. You said you would leave them alone, remember?

For example, Coffee Stain’s games are great - and that division itself is clearly very profitable. But they’re not particularly aggressive with monetization, despite running GaaS-style titles. And when you don’t have many ‘repeating revenue’ PC/console GaaS wins across the entire company, you need to have hits every quarter, every year, in a slightly scary, very busy market.

It’s a combo of this - and some of the non-’fundamentals based’ accounting I poked in my first write-up of Embracer - that led to the over-dependence on a big round of funding that never arrived. That shark: it’s still pretty valuable, market cap & IP-wise. But it seems to have paused swimming, and we hope it doesn’t Damien Hirst itself.

The game discovery news round-up..

Finishing up the free newsletters for the week (Plus crew, hang out and get one more on Friday), there’s a whole bunch happening, and we’re rounding it up like this:

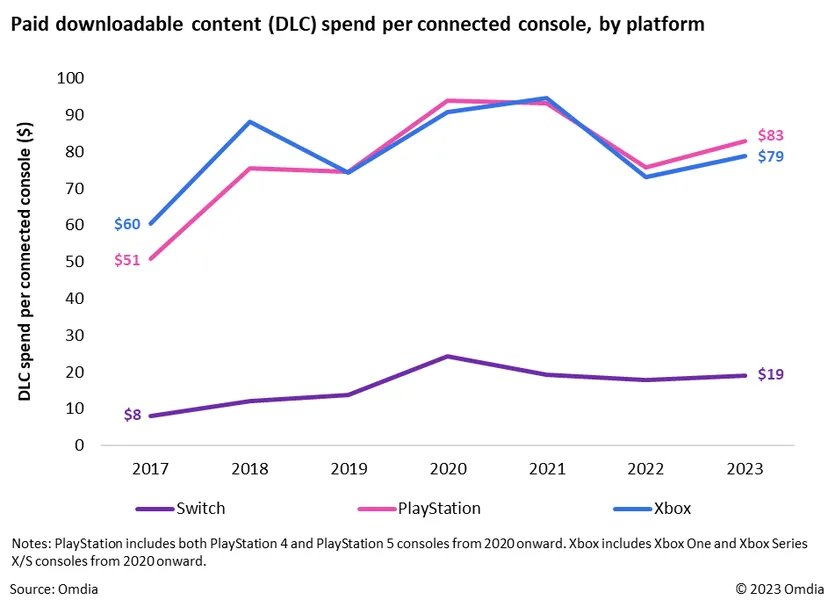

The research folks at Omdia published a piece on the latest Zelda not having DLC, and above are their estimates for ‘DLC [or IAP] spend per connected console’. This is fiendishly tricky to estimate, but we agree with the general vibe - Nintendo Switch is just not set up for DLC/IAP spending, except in F2P games.

Meta’s big roll-out of Quest 3 is happening just as send this newsletter. RoadToVR has a lot of the details - shipping starts Oct. 10th, and “The mixed reality headset is being offered in two variants, a 128GB version for $500, and a 512GB version for $650.” Both bundle with Asgard’s Wrath 2, and the 512GB version with 6 months of monthly game sub service Meta Quest+. (More via Variety, including Roblox getting a full Quest Store release & Xbox Cloud Gaming coming soon.)

Epic’s CEO Tim Sweeney keeps speaking out about ‘platform taxes’. The latest on X/Twitter, after spotting the Top 10 game firms by revenue in Xbox-leaked data: “Seeing Apple and Google in the top of the game revenue charts, making tens of billion of dollars every year, is disgusting. THEY DON’T MAKE GAMES! They just place an unwanted and useless toll both in front of games made by others.”

A small practical Steam tidbit from ‘marketing wizard’ Patrick Seibert: “You can test your Steam demo by entering app_install <appid> into the Steam Console tab. No need to generate keys and create alt accounts. Always launch with the console tab enabled: Create a shortcut to your Steam.exe and add -console to the target.”

Business-y microlinks: the U.S. FTC (bane of Xbox’s life!) just filed a wide-ranging lawsuit against Amazon over its physical shopping monopoly power; the actors guilds voted in favor of strike authorization against the game biz re: “voice, motion capture and stunt work on video games”; a ‘side lawsuit’ from gamers in the Xbox & Activision suit tried to target FOSSPatents guy Florian Mueller as a possible paid Microsoft propagandist, weirdly.

Sony’s gunning hard for those PlayStation 5 yearly hardware goals in Europe, per ‘John Welfare’ on Twitter: “Price promo in late July to early August.. Another in late August to early September… And now another for September 25th to October 12th that has the PlayStation 5 EA FC bundle at £429 (-£110) and €499 (-€120).”

Good news for ‘VR on Steam’ fans - Valve rolled out a giant update to the client that is “the first major step toward our goal of bringing all of what's new on the Steam platform into VR.” There a brand new UI with lots of current Steam features, and updated keyboard, integrated Steam/voice chat & improved VR-specific store.

Here’s a fun blog about strategy game cross-promotion (via an on-Steam page widget!): “Seventeen of us from the #TurnBasedThursday community cross-promoted our games during this year’s #SteamStrategyFest (Aug 28th — Sep 4th). We created custom icons for our games (with TBT-themed borders) and added them to a special announcement section of our Steam pages.” (Results small, but tracking is interesting.)

Seems like the Steam Deck - which people dig, btw - is staying the same for now, as Valve’s Pierre-Loup Griffais tells The Verge and CNBC: “It’s important to us that the Deck offers a fixed performance target for developers, and that the message to customers is simple - where every Deck can play the same games.” Notable boosts in device performance that are battery life neutral/positive, worth Valve doing a upgraded version? Not likely “in the next couple of years.”

Microlinks: a ransomware group claims to have breached PlayStation parent company Sony’s corporate systems; an interesting piece on the rise of dedicated player-operated servers for multiplayer games; PlayStation Plus is adding The Callisto Protocol to PS+ Essential this October - only 10 months after its debut.

Finally, Deus Ex co-creator (ahem, not ‘creator’) Warren Spector is one of the nicest guys in the game biz, and this self-written retrospective of his 40 years (!) in game development is a wonderful potted history. Please read it!

And relatedly, I still can’t get the ‘War Inspector’ joke in this Mega64 x CliffyB video I (co!)-commissioned for the GDC Awards out of my head, a decade+ later:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]