Analysis: which 'not-E3' games hit it big with gamers?

Also: why you shouldn't forecast equal console & PC sales for your games.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome to another week in video game discovery, crew! There’s been a lot going on in PC/console over the weekend (and late last week), thanks to the debris from the ‘not currently with us’ E3 creating a singularity for interesting game announcements.

Oh, and we have a new 25% off deal for our GameDiscoverCo Plus paid sub, making it <$10 a month if you sign up for a year - inc. a weekly game trend analysis newsletter, Steam game ‘Hype’ chart back-end, our member-only Discord - and our gratitude.

Which ‘not-E3’ games have breakout interest?

How do you even keep up with the literally hundreds of games that got new/updated trailers as part of the multiple streaming showcases over the last few days? Besides going to sites like Games Recap 2023 and scrolling through its 6 pages (!) of videos?

Well, never fear, since we’ve got two empirical methods of estimating interest in all of these announcements. And the first (above) is from GameDiscoverCo, and involves us looking at all 300-ish of these games that have a live Steam page, ‘before and after’.

We do that by looking at Steam followers (a public stat - ‘# of people who hit the follow button to get more news about the game’, it’s about 10% of wishlists) both at showcase time, and 18 hours after that specific showcase. Here’s the full list (Google Drive document) if you want to look for your own - or others’ - games.

As for the above ranking? Nobody would be surprised to see Bethesda’s Starfield topping it while adding pre-orders, but major interest (at least on Steam) exists for co-op heist sequel PayDay 3 & citybuilder sequel Cities Skylines 2 - both of which started pre-orders - and Pinocchio-themed Souls-like Lies Of P (pre-order & demo!)

Since we did all that work, we can also get a ranking of ‘median follower increase from all the games shown in each showcase’ (above), which is absolutely fascinating - and, we’re happy to note, bears some resemblance to the showcase rankings we did in Feb.

Secondly, since there were a lot of showcase games not on Steam - particularly in the Xbox and Summer Games Fest showcases? ICO’s Footprints.gg media monitoring service has ranked online press mentions, worldwide, for the showcases:

For Xbox, we can see standout games like Star Wars: Outlaws, Fable, and Avowed popping high up the list while not having standalone Steam page presence - as well as the expansion for the already-released Cyberpunk 2077.

For Summer Game Fest itself, Sony’s Spider-Man 2 showcase and the latest Final Fantasy 7 remake segment came out marginally on top - with a lot of interest too for Mortal Kombat, Lies Of P, and more.

Finally, for the PC Gaming Show - note the article totals are reduced (by 5x or so!) from the Xbox and SGS showcases, because of the relative paucity of PC-specific media outlets - Lords Of The Fallen & Eternights ruled the roost.

[Footprints did graphs for other showcases too, available via two Twitter threads. Looks like # of mentions per show roughly line up with event prominence in GameDiscoverCo rankings.]

Console sales not matching PC? It’s the norm…

While doing some consulting recently, GameDiscoverCo calculated a bunch of ‘competitive game’ sales estimates for a client - for a range of nearly 10 small/medium sized non-AAA games, some of which had grossed many millions of dollars.

One of those was Black Salt & Team17’s ‘spooky fishing adventure’ Dredge, which has been a pretty big/profitable hit for a smaller PC & console game. Yet even for this hit game, we estimate it’s sold >500,000 units on Steam, 50-75,000 on PlayStation, a similar amount (50-75k) on Xbox, and >100,000 on Switch.

But as you can see, Steam is stronger than all the consoles combined for this game, by quite a lot. This was true for the other games that we did estimates for, too. So our client asked the right question.. should he be surprised, was this just a fluke with the particular genre he’s looking at, or is it more universal? We said:

“On these types of games selling less well on console, it is kinda a surprise to many, yes. But basically, 95% of small/medium PC games just won't do as well on console because:

On PlayStation and Xbox, there are just hordes of people who mainly see these consoles as FIFA, Fortnite and Call Of Duty machines. They will try spectacular new AAA games, but are not really attracted to more independent or less visually attractive titles in the numbers that PC players are. (And Game Pass is the more natural venue for those games on Xbox anyhow, currently.)

PC is more internationalized, so you're getting quite a few buyers from big countries that have less consoles in them, too. So there's a wider selection of possible players, which increases the possible sales - especially for PC-centric ‘deep, strategic’ genres, but in general.

On Switch, the console has always skewed extremely first-party centric, and in 2018 or 2019 games were doing better from third-parties. But then the platform got flooded with games and discovery is quite poor after your initial launch. (And a lot of Switch buyers beyond the hardcore are happy to stick to expensive, great Nintendo-created games.)

That's the main difference with PC games. You can keep selling on PC over time to new players coming in who discover your game via YouTube. Or they have your game on their Steam wishlists and keep getting emailed about it. So the long tail is just worse on console, unless your massive Switch discount goes viral, etc…”

There’s no hard and fast rule, though. There are outliers (<5% of all games) that DO sell as well on console as they do on PC. We’d divide these into two main categories:

AAA-ish games that appeal to the mainstream: for example, GameDiscoverCo estimates that the new Resident Evil 4 remake sold 1.7 million units on Steam, 500,000+ on Xbox, and close to 1.5 million on PlayStation. Other obvious recent examples include Street Fighter 6, Hogwarts Legacy, Dead Island 2, etc.

Low-selling indie titles with some kind of console (particularly Switch!) attraction: it’s quite possible, with some types of smaller niche games, to sell 5k units on Steam and 5k units on Switch (and then 3k units on PS/Xbox, maybe?) So this technically qualifies as an outlier. But 50k units on each of the consoles and then 50k on Steam? Just doesn’t happen - don’t put it in your forecasts!

There are various other more extreme outliers. These are often titles that have a lot of YouTube/Twitch coverage, so pick up regular buyers from people manually searching for them on consoles. But this is the shape of the biz - fight us if you disagree.

The game discovery news round-up..

Finishing up on this fine Monday, here’s a look at some of the major platform and other discovery news that hit since last week, as follows:

Meta-analysis on ‘not-E3’ week? Summer Game Fest’s trappings brought home how disjointed things felt without a central event, but Xbox put together an impressive showing - helped by the fact that 21 of the 27 games they showed will be in Game Pass. (A powerful incentive to unveil in Xbox’s showcase, right?)

The Xbox showcase on Sunday came with some platform-level announcements, albeit in ‘cherry-picked stats’ manner: “last quarter we saw a 46% increase [YoY] in people playing PC games on Game Pass”, and “our revenue from subscriptions overall reached nearly $1 billion last quarter.” Oh, and 150 million MAUs on Xbox first-party games - inc. Minecraft on other platforms, we presume?

Niko Partners’ China games market report includes this interesting tidbit: "PC games revenue generated overseas by Chinese owned companies rose by 22% in 2022 and is expected to grow by a 13.8% CAGR through 2027 – which is higher than the domestic growth rate by a significant margin."

More evidence that PS+ and Xbox (and esp. PC?) Game Pass might be struggling to add lots of subscribers? Circana’s Mat Piscatella says: “According to Circana's Games Market Dynamics reporting, April '23 sub spending in the US was only 2% higher than April '22. Finding new subscribers beyond the console ownership base has proven very difficult thus far.”

New World Notes spotted that “Apple is… working directly with leading metaverse platform Rec Room on being a full VR application for Vision Pro.” So its VR tech - including hand tracking - is working, but Apple is very deliberately not putting this front and center. (We hope the ultimate Vision Pro use isn’t for a William Gibson-esque ‘degraded future’, as Dave Karpf darkly hypothesizes.)

Do big platforms need to be at large B2C game events? Before the pandemic, the answer was ‘absolutely!’ Now, the answer is more clouded - with PlayStation apparently confirming that it’s skipping exhibiting at Gamescom in Cologne this August. (That show will still be huge, and now includes Nintendo, but still…)

On the hardware side for Xbox, Series X shortages were acknowledged - “supply chain issues have now eased and we’ve been able to increase our [Series X] supply globally”, and a new 1 terabyte SSD version of the Series S is rolling out in September for $350 USD, continuing a smartly diversified strategy.

That burgeoning video game platform Netflix announced its summer 2023 line-up, all ‘free with a Netflix logon’ on iOS and Android, including a chess tie-in with The Queen’s Gambit, Cut the Rope Daily (a daily puzzle version of Cut The Rope), and Oxenfree II, from its internal studio Night School - which’ll also come to PC & console as a regular paid game.

What did Meta think of Apple’s Vision Pro, btw? Seems like it was a sigh of relief at contrasting approaches: “their announcement really showcases the difference in the values and the vision that our companies bring to this”, said Zuck internally. Oh, and he added: “Our vision of the metaverse and presence is fundamentally social and about people interacting and feeling closer in new amazing ways. By contrast, every demo Apple showed was someone sitting on a couch by themselves.”

U.S. video game physical retailer (in-store & online) GameStop is a platform too, of sorts, which is why Brendan Sinclair’s GI report is worth reading: “GameStop is doomed… that's the mood following the company's quarterly earnings report this week, which saw a net loss of $50.5 million and the termination of CEO Matt Furlong, the sixth man to head up the company since 2017. But GameStop has been doomed for a very long time.”

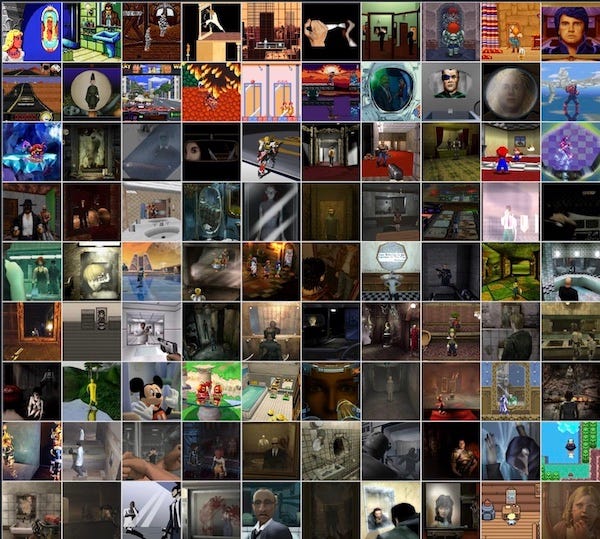

Finally, do you think a mirror is a window to a person’s soul? Wait, no, that’s the eyes. But if you love mirrors in video games, Eastern Mind has your back - “this compilation of mirrors/reflective surfaces in video games is the result of close to a year of research”:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]

This is really fantastic. There is such an enormous difference between the games by streaming interest and how they rank in article numbers. It's very interesting and eye-opening. Even in this era where anyone can have a gaming blog or video show, the difference is significant.

If I look at the spreadsheet, in both total followers after 18 hours and follow gains, there is a huge disparity. It would be interesting to see more of the data on numbers of articles and where the streaming hits landed with media coverage volumes.

Either way, great job. Thank you!